Introduction

There are no trading strategies that will generate a profit every single time, but there are some really basic strategies that can produce some pretty good results.

One such strategy makes use of exponential moving averages (EMAs), and more specifically, the 5 and 20-period EMAs.

Exponential moving averages provide you with a good indication of the current trend, and when you get a short-term moving average crossing a longer term moving average, ie the 5 crossing the 20 in this case, it is a good indication that the trend has changed.

So in other words, it gives you an opportunity to enter a position right at the start of a new trend.

How to Improve Your Chances of Success

This is not a foolproof strategy by any means because there will be times when you will get false crossovers that don’t turn out to be the start of a new trend, but there are ways to increase your chances of success.

One of the best ways is to use multiple time frames. For example, you might look for a strong upward price move on the daily and 4-hour time frame, wait for a period of retracement on the 1-hour chart, and then enter a long position when the EMA (5) crosses upwards through the EMA (20) on this same time frame when the longer term trend prevails.

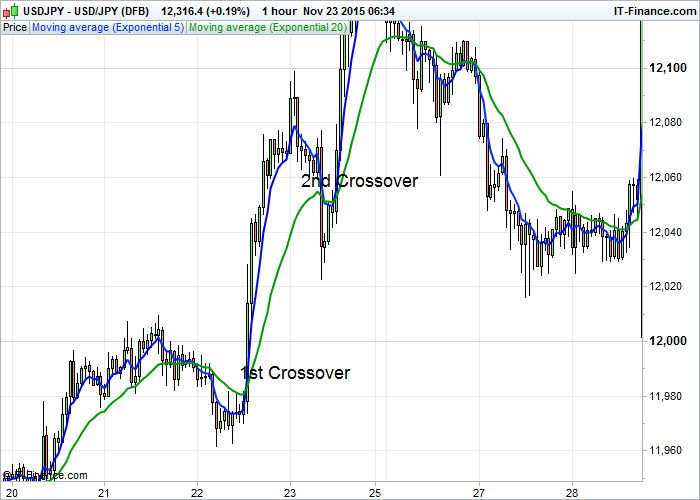

To give you an example, the USD/JPY had a strong price move upwards on the 4-hour and daily chart last month and was starting to trend nicely upwards before it retraced nicely with a downward EMA crossover (5 crossing the 20) on the 1-hour chart. It then crossed upwards once again when the trend resumed, which was a perfect entry point:

Indeed there was another upward EMA crossover the next day which would also have been profitable, but I always like to trade the first crossover whenever possible.

If you wanted to, you could also look for strong price moves on the 15-minute and 1-hour time frames, and then enter a position when you get an EMA crossover on the 5-minute chart, but it’s generally more profitable to use longer time frames if you can because the price moves can be quite small on the smaller time frames, which means that the spreads will really eat into your profits.

The Key to Success

What you are basically trying to do is identify pairs that are in strong trends on two longer time frames, and then enter a position when you get an EMA crossover in the same direction on one of the shorter time frames because this is an example of a high probability trade.

This is a lot more profitable than sticking to a single time frame, and is a strategy that many people, including myself, use to generate profits on a regular basis.

Exit Strategies

With regards to exit strategies, you have many options. One option is to run the position until the EMAs cross back in the other direction, ie when the trend runs to its conclusion, which can sometimes yield huge returns, but another option is to look to make a certain number of pips per trade, and move your stop loss to break-even as soon as it is in profit, which is another good strategy.

Final Thoughts

The point is that there are many ways that you can profit from the EMA crossover strategy, and the great thing is that you only really need to use two simple technical indicators.

You don’t need to stick to the 5 and 20-period settings either because you may find that you get equally good results from using a 10 and 20-period EMA crossover strategy instead.

Similarly, if you take a long-term view, the golden cross (upward crossover) and death cross (downward crossover) of the 50 and 200-day EMAs can be even more profitable if you wait for a pull-back and enter at the right time because the resulting price moves can be thousands of pips.

Simple is always best.

Too much clutter on a chart tends to confuse rather than clarify trend direction.

Hey, I am looking to implement this strategy in the coming months, looking to look for a strong trend on the hourly and enter on the 15 Min with the rules included above. Hopefully I’ll have my first profitable strategy after testing that yields a positive expectancy and stands the test of time. I am after strategies that can last a lifetime.

Sir,

I am struggling with a good entry point when ever a MA crossover is made. I am entering too early or too late. Can you help me providing some tips regarding this?

Thanks.

It’s generally a good strategy to wait for confirmation of a crossover, and then wait for a slight pull-back to the EMA. The only problem with this is that you sometimes don’t get a pull-back and therefore miss out on a trade, but that’s the chance you take.

try hullma crossover and only trade with the trend and my personal trend detector is 50 ema 30minute timeframe so if it is above 50 ema then for me its an uptrend then i use hullma or a combination of hullma x over for entry and pullbacks hope this help

this is a great strategy but I would pair if with divergence and when the cross happens wait for a pull back then enter. simple and neat. good trading folks.

Thank you a lot!

What will be the timeframe for intraday trading?

You can use any time frame, but trading crossovers on the 1-hour chart, while trading in the same direction as the longer term trend on the 4-hour and daily charts, can be quite profitable.

How many pairs would you recommend for a beginner or any other trader? Thanks for your great work

It’s generally best to stick to the 7 or 8 major pairs.

Thank you for your response.

Ive had great results with using this exact strategy but I only trade the cross when divergence is seen on the MACD. Its a very strong set up especially on the futures charts. Once I spot divergence I wait for the cross then I wait for price to pull back and touch the 20ema then I’m in. (short or long) which ever. Back test this and you will see it happen again and again. You’ll kick yourself twice for not noticing this set up. 😉

regards

bud

Thank you very much for this. That sounds like a very good strategy because I have also found MACD divergence to be a fairly reliable indicator.

Hey bro how are you what are the macd settings

I always use the factory settings for MACD. I KEEP IT SIMPLE!

How do u set up ur MACD?

Hi , Can you please tell MACD parameters ? Regards. Ravi

good one…thanks for sharing.

I have been using this strategy ever since you posted it..please but I’m confused on how many pairs to trade…should I just scout for the crossovers on any of the major,minor and cross pairs??

It’s generally best to stick to the major pairs because they will have smaller spreads and greater liquidity.

JAMES is right Nicholas. I usually just work with a handful of pairs that fit my personality. That may sound strange but these pairs do have personalities that you can sync up with. I love the aud/usd and for some reason this trade set up works really good with this pair. let me know how ya do.

Bud

Assuming there’s a strong uptrend on daily and 4 hours chart and u currently have an uptrend too on one time frame…should u wait for another cross over or wot in dsame direction

Hi there, what is your percentage of winning pls? Thanks

How to use this strategy for swing trading

@ Budfox, Please kindly tell us your MACD Settings you use for this strategy.

Thanks

Hello Jason, I keep my MACD at factory settings. 12,26,9. Just to clarify my trade set up. I look for divergence on the MACD or Histogram. I then wait for the 5 EMA to cross the 20 EMA then I wait for price to pull back and touch the 20 ema for my entry.. This trade has yielded me very good results. Please keep in mind I’m using the 4hr time frame. I check the daily to make sure its direction is going in the same direction as my trade.

Howdy BudFox,

I really appreciate your reply.

For more clarity from your reply:

1) You check to confirm that the TREND on 4 hour and Daily timeframes are the SAME before your entry?

2) Are your entries only done on the 4 hour timeframe?

3) From your experiences, after conditions have been met, and price pulls back, does it always touch the 20 EMA?

4) What happens if pull back doesn’t touch the 20 EMA, do you still ENTER, Or better still, what do you do in such scenario?

Plenitude thanks

Great work

Is MACD divergence more effective than the RSI diveregence?

James Woolley you earlier said “I have also found MACD divergence to be a fairly reliable indicator”

I’m not sure if you mean the MACD indicator itself.

Please can you elaborate more on what you mean by “MACD divergence” as it relates to this 5 and 20 EMA crossover strategy?

Here is a recent blog post that discusses MACD divergence in more detail:

https://www.theforexchronicles.com/macd-divergence-on-the-eur-chf-pair-in-2019/

Please, with the above strategy, can I make use of it on a 1hour timeframe ??

Hello, kindly inform if I can use the 5 and 10 cross over in H1 and how do I identify divergence

Hi thx for the article , do you wait for candel close when using this strategy in both the longer and shorter time frame or just enter at the cross . I am looking use it with 1 hour cross and monitor entry on the 1 min cross , does this seems ok ? , thx

maybe ok on the daily chart but below that is cut throat

i use 9/20 ema on daily and wait for pullback on 4hr or 1hr and good for swing and short term

Absolutely Agree

Please, is it a must to allow the price to pull back before making an entry?

What what difference would it have if I make entry immediately after the 5, 20 EMA crossover? Thanks

Would you be able to provide us with some examples of your trades? Thank you