Introduction

It is often said that a good trading strategy should aim to have a risk/reward ratio of at least 1:1.5 or 1:2 because then it doesn’t necessarily require a high win ratio in order to make money.

So in other words, if your stop loss is 10 pips, your profit target should be at least 15 or 20 points away from your entry price every time.

Nevertheless, a lot of short-term traders still try to come up with a strategy that targets lots of small gains, but have a very undisciplined approach when it comes to stop losses.

They will either not use a stop loss at all, or will place their stop loss a long way away so it is only triggered if a trade goes horribly wrong, and has plenty of time to hit its initial target without being taken out early.

Either way, this is generally a very bad strategy and will nearly always result in huge blowouts at some point.

Real Life Example – ThePipsMasterUK

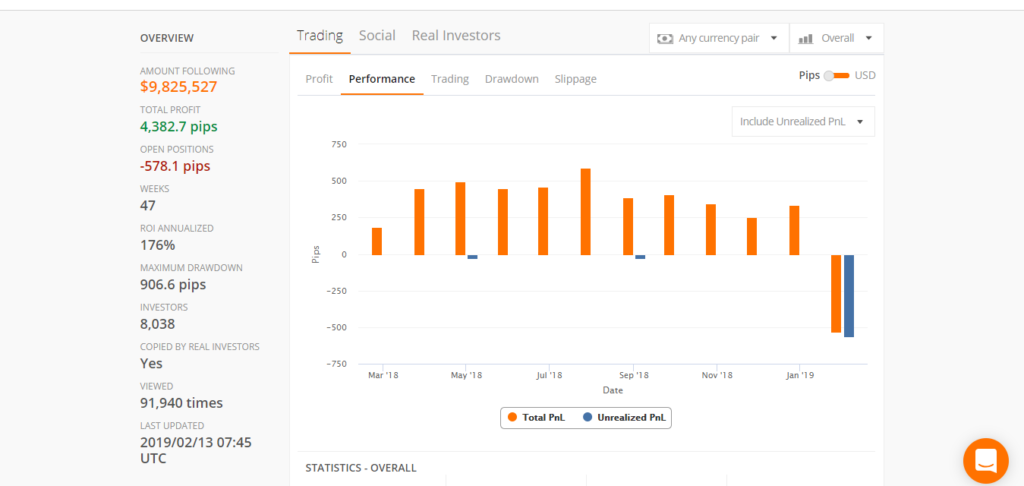

ThePipsMasterUK was previously the number one trader on ZuluTrade, with thousands of copiers and millions of dollars copying his signals.

As previously mentioned on this site, his night trading strategy on the EUR/USD pair targeted gains of around 6 pips per trade, and to his credit, it has been a very profitable strategy for several months now.

The problem is that he applies a stop loss of 150 pips, which means that if there is a time when a trade misses its target and reverses strongly in the other direction, there is a strong chance that it will incur massive losses, and that’s exactly what has happened in the last week or so.

After taking 5 long positions on the EUR/USD pair, the price moved against him and his copiers, and came close to hitting the 150-pip stop loss, at which point he broke another golden rule by extending the stop loss to 200 pips and then extending it to 250 pips when this was nearly taken out.

Subsequently, a lot of people closed out their trades manually or were automatically stopped out when they received margin calls, which resulted in them incurring huge losses.

Therefore months of profits were wiped out in an instant because of a crazy stop loss strategy. To target profits of 6 points with a stop loss of 150 pips is exceptionally risky, but to extend this stop loss even further when it is close to being triggered is complete madness.

He may still get lucky because the EUR/USD has bounced back a little, but even if it gets back to break-even, it is still a very risky strategy that is unlikely to be profitable in the long run purely because of the small 6-pip price target and the large 150-pip stop loss, particularly if he continues to extend it whenever it comes close to being triggered.

Final Thoughts

The point I want to get across is that it is rarely a good idea to come up with a strategy that targets small gains but uses no stop losses at all, or has an emergency stop that is always a long way away from the entry price.

It is usually only a matter of time before disaster strikes and a trader has no option but to accept a huge loss when a trade goes horribly wrong, which it inevitably will at some point.

So if you are serious about making money as a forex trader (or want to make money from copying other traders), always use a strategy that has a risk reward ratio of 1:1.5, and preferably at least 1:2 in order to avoid these huge losses.

Leave a Reply