Introduction

I think a lot of traders take long positions and short positions on various different currency pairs without really knowing what moves the markets.

That’s not really a problem if you are trading the 1, 5 or 10-minute charts, for example, because it is possible to trade these charts using technical analysis, trendlines and support and resistance levels, or by simply trading price action.

However if you are trading the daily or weekly price charts, for example, it is much more important to be aware of the wider economic picture because the price of a particular currency pair will be heavily influenced by these fundamentals in the long run.

The Main Influencing Factors

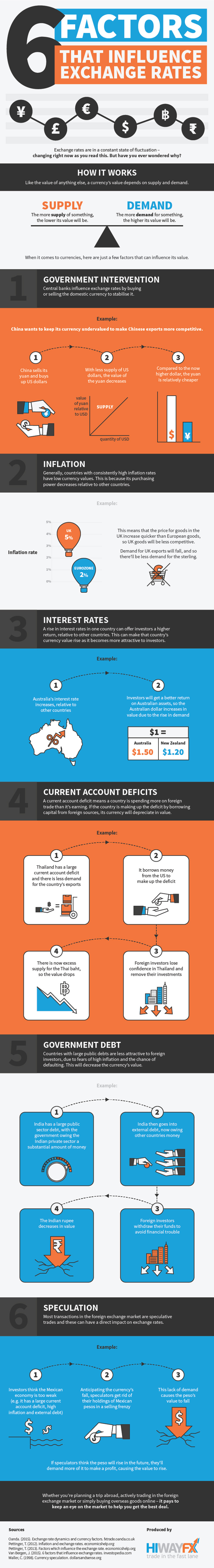

I have recently found a new infographic that does a pretty good job of highlighting all of the main factors that influence exchange rates:

Source: Visual Capitalist

I think most people will be aware of the effect of interest rates on a country’s exchange rate because many Western countries have already started to increase their interest rate (or are actively considering increasing their interest rates), and it has been discussed a lot in the news.

In simple terms, if a country raises their interest rates, it will generally cause their currency to appreciate in value. So it is worth keeping this in mind when taking a long-term trading position.

I think after what happened to the Turkish Lira this week, many people will also be aware of the devastating effect it can have if people suddenly start dumping a particular currency due to an economic crisis, for example, and this is also an influencing factor that is highlighted in this infographic.

Apart from these two factors, there are four other factors that forex traders (and people generally) should be aware of.

For example, people need to assess the general economic health of a country when estimating the future price of a particular exchange rate.

Inflation rates are very important because high inflation generally leads to a weaker currency, but it is also important to analyze the current account deficit because if a country is spending more on imports than it is earning from its exports, this can weaken their currency over time due to increased borrowing.

Another influencing factor is the level of debt that a particular country has because as this infographic points out, foreign investors are less interested in investing in countries with large public debts, which causes their currency to weaken in value.

Finally, as has been highlighted in recent years with China and just recently Indonesia and Hong Kong, government intervention is another key factor because this is an effective, if controversial way to control a country’s exchange rate.

Closing Comments

As you can see, there are many factors that influence exchange rates, and they are all very important because in the long run it is these fundamentals that drive the markets.

However it is also worth noting that one-off events can also have a dramatic effect on a country’s exchange rates. You only have to look at the effect that Brexit has had on the British pound since the result of the referendum was announced for evidence of this.

So although forex trading can never be described as easy, it is certainly a lot easier to make long term profits if you take all this information into consideration before taking a position.

Leave a Reply