Introduction

There have been hundreds of prop trading firms popping up in recent years, many of which have been completely unregulated.

Subsequently, they have conducted some fairly dubious practices in order to prohibit or ban profitable traders, and prevent them from passing their challenges.

I think we have all read about what happened with My Forex Funds, for example, which used to be one of the leading names in this space.

In addition, many others have also made life difficult for traders with slippage, downtime and delayed executions, for instance.

So it is interesting to see that Oanda, one of the leading forex brokers, and arguably one of the most trusted brokers, are entering this space with their own unique prop trading program – the Labs Trader program.

Why are Oanda Starting a Prop Trading Program?

I think it is fairly obvious why Oanda and other currency brokers are interested in starting their own prop trading program.

The fact is that these prop firms have enjoyed huge success in recent years and have racked up some huge profits because very few people actually pass the challenges.

So it is only natural that they will want a slice of the action, particularly as many traders are now trading through these firms rather than through a traditional broker.

Oanda have a large and active database of traders that they can promote this service to, and also have significant marketing resources to attract new traders.

Plus they should be able to offer tighter spreads, better executions and a generally more professional service than many of the smaller prop firms.

Who Can Join This Oanda Labs Trading Program?

It should be pointed out that this program will not be available to traders from all countries.

According to the official press release, Oanda Labs Trader is only available to residents of countries serviced by Oanda’s Global Markets division, which means that traders from the UK, the US, Australia or Canada, for instance, will not be able to join their prop trading program.

What Challenges / Account Sizes are Available?

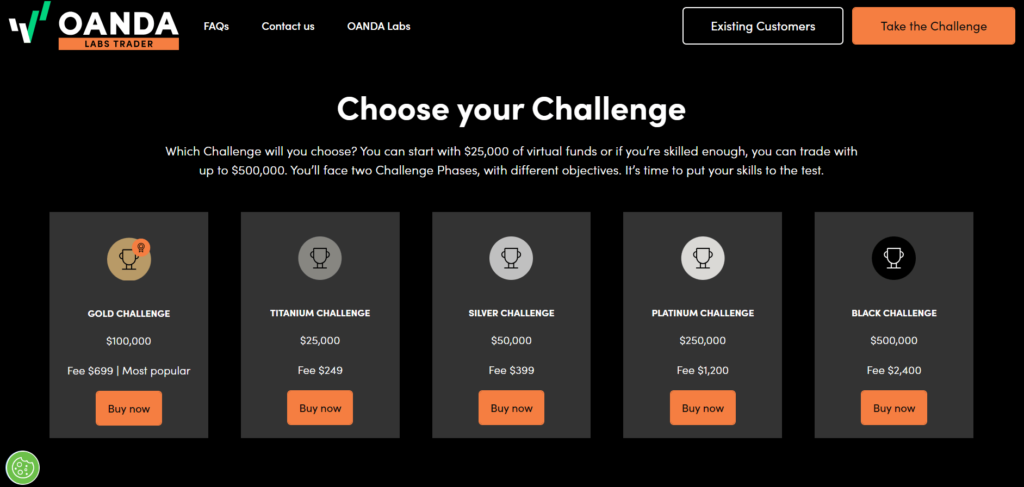

As with many similar prop firms, Oanda are offering a variety of different challenges and account sizes, as you can see below:

The smallest account size that you can go for is the $25,000 Titanium account, which will set you back $249, but you can also take the $50,000 Silver challenge for $399 or the $100,000 Gold challenge for $699.

Alternatively, you can pay $1200 to take the Platinum challenge in the hope of obtaining a fully funded $250,000 account, or you can take the Black challenge for $2400 in the hope of obtaining a fully funded $500,000 trading account.

Whichever one you go for, you will need to achieve a 10% profit in phase one followed by a 5% profit in phase two to pass the challenge (without hitting the daily drawdown limit of 5% or the maximum drawdown of 10%).

You will then be able to start earning 75% of any profits on a fully funded account.

Final Thoughts

I think many people were very excited when they heard the news that Oanda were creating their own prop trading program because they are undoubtedly one of the more reputable brokers with operations in numerous countries.

However this will quickly have turned to disappointment when it became clear that this service would not be available to traders in the UK and the US, for example, and several other countries.

Nevertheless, if you do live in one of the countries serviced by Oanda’s Global Markets division, you may want to consider signing up to Oanda’s Lab Trading program because they are offering the chance to obtain a fully funded account up to $500,000.