Overview of the New Rules

The European Securities and Markets Authority (ESMA) really shook up the CFD and spread betting industries earlier this year when they announced that stricter new leverage rules were being introduced in 2018.

These rules are actually designed to protect traders from racking up big losses, particularly inexperienced traders who are likely to over-leverage themselves, because it will no longer be possible to lose more money than you have in your trading account.

Binary options will also be banned in Europe, which will help to eradicate all of the scam binary brokers that are cropping up on the internet, and will once again prevent inexperienced traders from losing money.

These two new rules will be welcomed by many people within the industry, but the ESMA are also increasing the margin rates for all markets, which is not such welcome news because this will have a major impact on every trader who likes to use CFDs (and spread bets) to trade the markets.

New ESMA Margin Rules (From 1 August 2018)

The new margin rates for Contracts for Difference (CFDs) are as follows:

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs, gold and major indices

- 10:1 for commodities (exc. gold) and non-major indices

- 5:1 for individual stocks

- 2:1 for cryptocurrencies

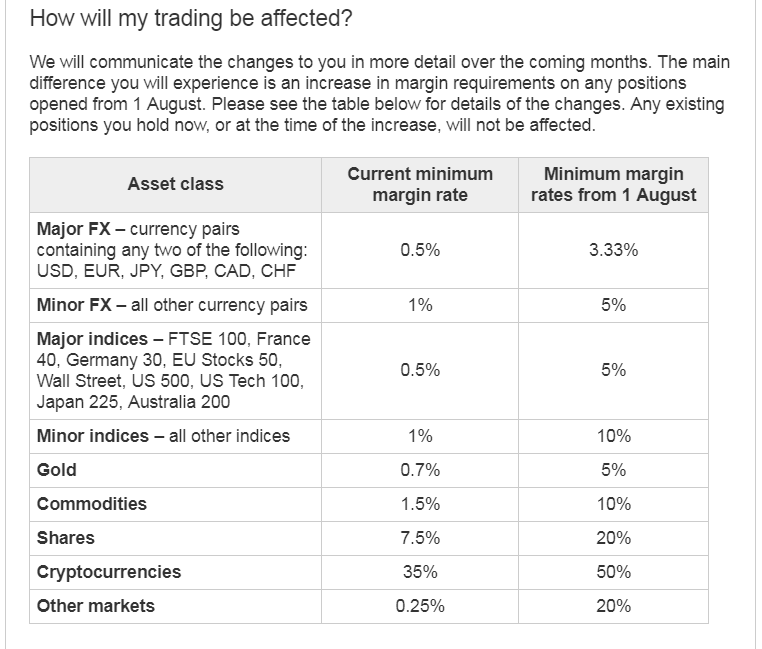

To put this into some kind of context, you can take a look at IG’s margin rates before and after these new rules were introduced to see how much of an impact they are likely to have:

Examples

Anyone with a large trading account of say £100,000 is unlikely to be affected too much if they already use a sensible size stake per trade, but it is those people who have a more modest trading account who will be affected a lot more.

That’s because if you were to open a £2 long position on Shell (RDSB) at 2700p (equivalent to buying £5400 worth of shares), you will now require £1080 margin instead of £405, which is a big difference.

Similarly, if you were to open a £2 long position on the GBP/USD pair at 1.3100 (shown as 13100), you will now need to have £873 in your account just to cover the margin, instead of the £131 that would have been required previously.

The opportunity to make big profits from cryptocurrencies are also going to be limited due to the new 50% margin rate. That’s because if you wanted to open a long position on Bitcoin at say 7500, you would need to have at least £3750 in your account just to cover the margin on a £1 long position.

So hopefully you can now see why so many CFD and spread betting traders are worried about these new changes. If you want to open multiple positions on several different markets, you will now require a lot more margin to do so.

The Impact of These New Rules

Despite the fact that many traders will be unhappy with these new margin rates, the new rules seem to be having a positive effect so far.

Capital.com introduced these new rates from 1 June, and the performance of their new traders improved as a direct result of these changes:

“Comparing their performance against published industry performance levels and historic client performance reveals that users who traded using the lower leverage limits traded more successfully and were significantly less likely to face a margin call. The proportion of users facing a margin call within the first 15 days of trading fell from approximately 30 per cent in the months before Capital.com introduced the ESMA limits, to just 5 per cent in June. The size of the average loss fell by over 80 per cent.”

Final Thoughts

So even though many of us have become accustomed to trading the markets with generous leverage, we now have no option but to accept the new margin rates, adjust our trading accordingly, and either lower our risk per trade or add more capital to our accounts to cover the extra margin.

It is not ideal by any means, but if it prevents new and inexperienced traders, as well as some more experienced traders from losing more money than they can afford to lose, it can only be a good thing.