What Does Pyramiding Mean in Trading?

Pyramiding is a popular strategy used by many profitable forex and futures traders that involves adding to your winning trades as the price moves in your favor in order to maximize your gains.

So for example, if a trader believes that a particular currency pair will increase in value but doesn’t necessarily want to enter immediately with a full position, they may go long with one third of a full position, go long with another third when it moves 20 pips in their favor, and then enter the final third when it has moved a further 20 pips, ie 40 pips in total, in their favor.

Alternatively, they may instead prefer to take a 50% position initially, followed by 30% and 20% if the trade plays out as planned.

This pyramiding technique is often used to turbocharge profits as a trade develops and conviction is high.

A trader may have already entered a short position with a full position, for instance, but after moving sharply downwards, consolidating and forming a triangle pattern, a trader may double up and enter another full position if the price breaks below this triangle to start another leg downwards as part of a longer downward trend.

What Does Pyramiding Mean in Stock Market Investing?

Pyramiding in stock market investing is a strategy that involves buying a stock and continuing to buy more as the share price rises in order to maximize profits.

The pyramid technique in investing is therefore very similar to pyramiding in trading, although it is generally only used when a share price is rising in value, whereas traders will also adopt a pyramid technique when shorting a stock as well.

What is the Difference Between Pyramiding and Averaging In/Down?

Pyramiding is not to be confused with averaging in or averaging down. Pyramiding is where you add to winning positions as they move in your favor, whereas averaging in is where you increase your position size as a trade moves against you in order to improve your overall average price and help to reverse any losses.

For example, if a forex trader is convinced that the GBP/USD currency pair is going to move 300 points higher when the price stands at 1.2500, they may choose to enter a further long position if the price were to drop 50 points to 1.2450 and then add another equal position if it were to continue to fall to 1.2400.

This has the effect of averaging their entry price down to 1.2450, giving them a more favorable average price than their initial position, but it also increasing their risk of making a substantial loss due to the larger sized position.

It also puts them them on a running loss of 50 points when the price is at 1.2400, so the GBP/USD needs to go up by 50 points just to get them back to break-even.

What is an Example of a Pyramid Trading Strategy?

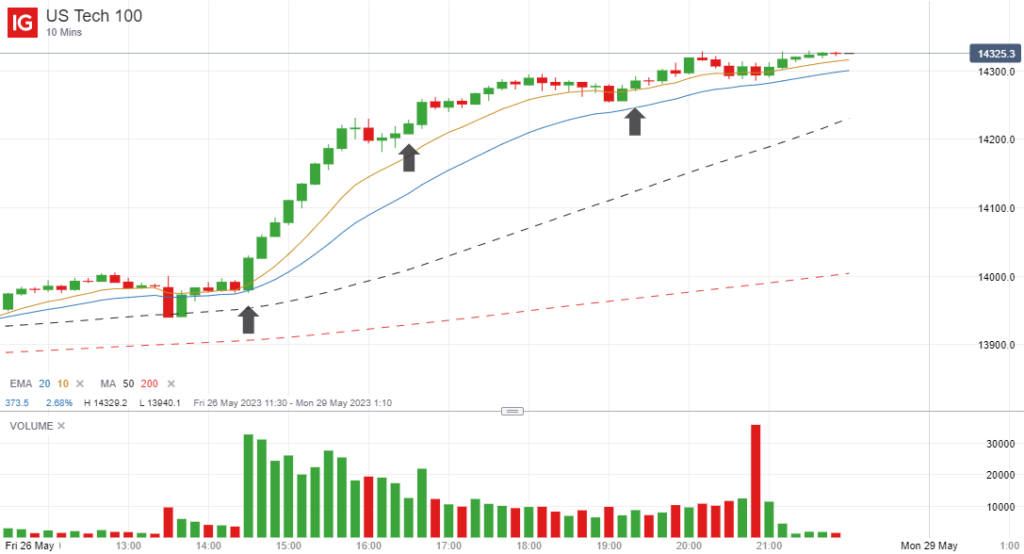

To demonstrate how pyramiding is used by traders, let me give you a real life example of how a pyramid strategy could have been used to trade the Nasdaq 100 yesterday.

When the price of an instrument moves strongly higher right from the open, it will often continue to move higher in a stair step fashion, ultimately closing the day at or close to the day’s high.

This is marked by big moves higher, periods of consolidation, and then a resumption of the trend, and this is exactly what happened on the Nasdaq yesterday.

So if a trader had anticipated that this market was likely to have a really strong day, they may have entered a long position just after the market opened, and then added to their long position with new positions after the price continued trading higher after each major consolidation phase.

These long positions are indicated by the arrows on the chart, and demonstrate how pyramiding can be used to catapult your profits.

If this trader were to then close out all of his positions just before the close, he would have had three positions in profit instead of just the initial trade that he opened at the start of the day.

Is Pyramiding a Profitable Strategy?

The truth is that pyramiding can indeed be a hugely profitable strategy when it is executed well, but it can also be a very stressful and risky strategy because you are increasing your overall position size when a trade has already moved in your favor.

Therefore it increases your chances of making a bigger loss if the trend runs out of momentum and moves back to your initial entry price.

The key to success is to employ a sound risk management strategy when using a pyramiding technique.

One way of doing this is to move your stop loss up to break-even when you enter a second position, reducing your potential losses, but you can also go further and move your stop loss to half way between your first and second positions to ensure that you will at least break even and cannot possibly lose. You can then continue trailing your stop with any additional positions that are taken.

This way you still have the potential to make outsized gains, but are also managing your downside risk as well to prevent any huge losses being incurred.

Tom Hougaard Pyramid Trading Strategy

One day trader who famously uses a pyramid trading strategy to maximize profits is Tom Hougaard. He is not afraid to go big when he feels that he has made the right call and a position is highly likely to continue moving in his favor.

You can see this for yourself if you ever see him trading live, but he also talks about this in many of his YouTube videos.

Here is an extreme example of a high stakes pyramid position that he took a few years ago:

Trend Following Pyramid Trading Strategies

The Turtle Traders were also famous components of pyramiding. They would trade breakouts of 20-day highs and would enter up to three additional positions once a position continued to move higher. For example, the 55-day high would often be a key level where they would add to a position.

However there are many types of trend following strategies you can use yourself. For instance, if the price moves sharply higher before dipping below a short-term moving average, such as a 5 or 9-period EMA, you could add an additional long position once the price closes back above this moving average because this would indicate that the bullish trend is likely to continue.

Similarly, you could use specific fibonacci retracement levels to go long on any pullbacks from existing positions that have already moved well into profit.

A lot will depend on which time frame you like to trade. The Turtle Trader’s strategy works for longer term investing and trading on the daily chart, while Tom Hougaard’s pyramiding strategies are designed to extract huge gains on the shorter time frames.

Reverse Pyramid Trading Strategy

One final type of strategy that I want to discuss is the reverse pyramid trading strategy. This is essentially where you start off with a very small position and then add larger and larger positions as your confidence grows in the position.

Reverse pyramiding works very well when trading trend reversals because if you wrongly predict that the current trend is reversing, you will get stopped out early for a small loss, but if the price is indeed reversing and your initial position is already nicely in profit, you can add larger positions now that a trend reversal is underway, and move your stop loss up to break-even or trail it as the trade progresses.

Final Thoughts

It’s important to point out that pyramid trading is not for everyone. It is a high risk strategy that can result in huge losses if a trade moves against after you have built up a large position.

However with strict risk management rules in place, it is possible to achieve outsized gains using this approach when the right set-ups present themselves and you are able to spot these strong emerging trends.

Leave a Reply