Introduction

It’s always a good idea to look back on the previous year’s trading results at the end of a year, reflect on these results and set yourself goals for the coming year in order to keep improving as a trader / investor.

So having just completed a full year as a trader on the eToro social trading platform (user account = SteadyProfits), I thought it would be a good idea to talk about my personal trading goals for 2020.

This is primarily for my own benefit so that I can look back at this blog post at the end of the year, and see if I actually achieved these goals, but it may also help you to get into the mind of how an experienced trader thinks (as someone who has been trading the markets for over 20 years now).

Profit Target

The first thing I will say is that I never set myself a specific profit target. I will take whatever I can get from the market.

In 2019 the global stock markets rallied strongly, and even the UK markets surged higher at the end of the year after Boris Johnson’s Conservative party won the General Election.

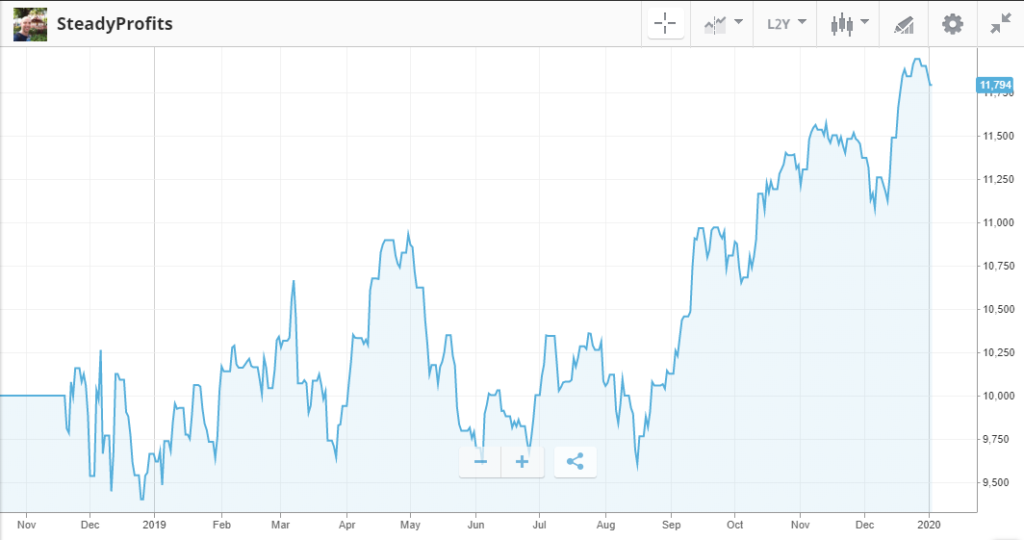

I would like to think that my trading skills were solely responsible for making a 20.98% gain last year and turning a notional $10,000 into $11,794 since I first joined eToro in November 2018, as shown below, but I have to be realistic and accept that the strong markets contributed to this impressive profit result in a small way.

So what I am basically saying is that I can’t expect to make a similar gain of over 20% if the markets were to fall 20% in 2020.

However my goal is to still make an overall profit regardless of market conditions thanks to having a more diversified portfolio, which could include bonds and commodities, for example, and not just stocks.

High Yield Portfolio

A trademark of both my eToro trading account and my main ISA is that they are both full of good quality large-cap stocks that pay generous dividends.

This is one of the main benefits of investing in the UK stock market. There are many large companies that are well-past their growth stage and now just keep growing their profits slowly and distributing cash to shareholders every year.

Examples of such stocks include Aviva, BP, HSBC, Royal Dutch Shell and Imperial Brands, all of which I currently hold in both my eToro account and my ISA accounts, and I will continue to invest in such stocks in 2020, particularly when their share price trades at a discount and represents good value.

Regular Income

Following on from the last point, I will also continue to invest in stocks that pay dividends regularly in order to give myself a constant revenue stream, which I can then reinvest back into the market to benefit from compounding.

I am a big fan of any assets that pay dividends quarterly, or even monthly if possible, which is why I will continue to buy large-cap stocks that pay generous quarterly dividends, as well as good quality REITs that distribute profits on a quarterly or monthly basis.

Returning to Forex Trading

I used to be quite an active forex trader before I became more of an active stock trader and investor, and I plan on doing a little more currency trading in 2020. That was the whole reason why I started this blog to begin with.

Therefore I will be going back to some of my tried and tested strategies where time permits, and may also start to develop some new forex trading strategies.

Attracting More Copiers

One final goal that I hope to achieve in 2020 is to attract more copiers on eToro. I aim to do this primarily by continuing to produce good results, but also through the use of this website and an increased presence on social media.

As of right now at the start of 2020, I currently have five people actively copying all of my trades, but I would like to have at least 20-50 copiers in the coming year and at least $100,000 AUM (assets under management), which is a fairly conservative target that I should hopefully be able to achieve.

This will enable me to move up through the levels of eToro’s Popular Investor program and subsequently generate more revenue, which in turn can be put to use in the market.

Leave a Reply