Introduction To eToro

I have known about eToro for a long time because they have always been one of the most popular social and copy trading platforms.

Indeed as a seasoned trader myself, I have always been attracted by the idea of other people copying my trades, but have never really been tempted to join eToro because the spreads are quite large for many of the major forex pairs, and they didn’t really have many other markets that you could trade.

However after discovering that they now quote prices for FTSE 100 and FTSE 250 stocks and enable you to actually own stocks and receive dividends, in addition to being able to go long or short via CFDs, I have now decided to open an account and start trading.

Trading Capital

After going through the verification process, I have already made my first deposit and started placing a few trades.

My initial deposit was actually quite small because I wanted to test out the trading platform first of all before I start trading with serious money, but I soon learned that this wasn’t really enough because the minimum trading size for stocks is $500 for new traders who have joined after 2017.

So I will be adding some more funds soon because I don’t really want to be trading stocks with leveraged CFDs because of the overnight fees that you have to pay every day.

eToro Goals and Ambitions

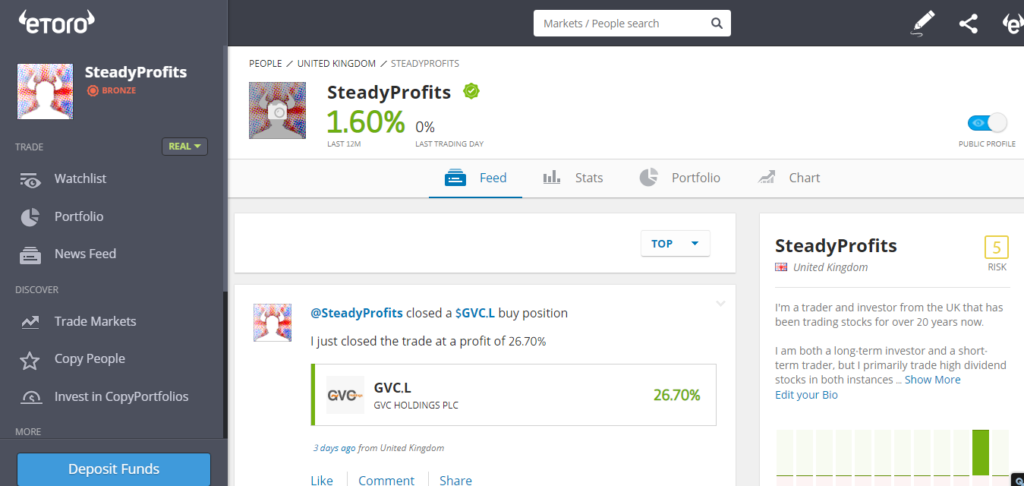

As I mention in my trader profile (SteadyProfits), I have been trading stocks for around 20 years now, and therefore have a lot of experience.

I have already built up a decent sum of money in my ISA over the years, but I hope to achieve the same results with eToro so that I can ultimately become a Popular Investor, build up a large following and help other people make some money.

To be honest, I also view this as an exciting challenge and a chance to really test myself, which is why I have set my sights high. My goal is simple – to become one of the top traders on eToro.

Trading Style

Although I have traded forex for many years as well, hence why I originally set up this website, I don’t currently intend to trade currencies with this account because I actually enjoy trading stocks a lot more, and don’t necessarily want to be sat in front of a computer screen all day.

I have no intention of trading cryptocurrencies either because this is far too risky for me, and in some respects is little more than gambling, even if you are using technical analysis.

So I will primarily be trading UK stocks and ETFs, and although I may make use of CFDs to open some short or medium-term trades, I will generally be buying stocks outright once I have a fully funded account to avoid paying overnight financing fees.

I always look for oversold / undervalued stocks and tend to focus on large-cap dividend stocks because this reduces my risk and gives me a steady flow of income, and by reinvesting these dividends into other high dividend stocks, I have found that you can really benefit from the effects of compounding over time.

I am prepared to hold on to stocks for days, weeks, months or years, and if a company is consistently growing both their earnings and their dividends year on year, I am prepared to hold on to a stock forever.

I don’t really set myself any profit targets. My goal is simply to build my capital over time through trading and investing in high dividend stocks, and consistently reinvesting the dividends and profits.

Early Trading Results

I have only been trading for one week so far, but have already placed three trades in that time.

As mentioned above, I am still using a small amount of capital and haven’t fully funded my account yet, so I have been confined to using CFDs with 5x leverage, which is far more risk that I would ordinarily like to take on.

Nevertheless, the early results have been OK. I bought LLOY at 54.74 and sold the same day at 55.35, and also bought one of my favourite stocks, GVC, at 760.18 and sold at 800.78 three days later.

I also bought IMB (IMT.L on eToro) and collected the dividend on ex-dividend day, but this position is still in the red at the time of writing. However it is looking massively oversold and should hopefully move higher soon.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results.

I will be posting regular updates on my eToro feed, but will also be posting regular updates on this blog as well.

Whatever happens, I’m really excited to be a member of eToro because it has given me a whole new challenge, and once I have added some more funds, I will really be taking this seriously.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management. 81% of retail investor accounts lose money when trading CFDs with this provider.

Leave a Reply