New Funds

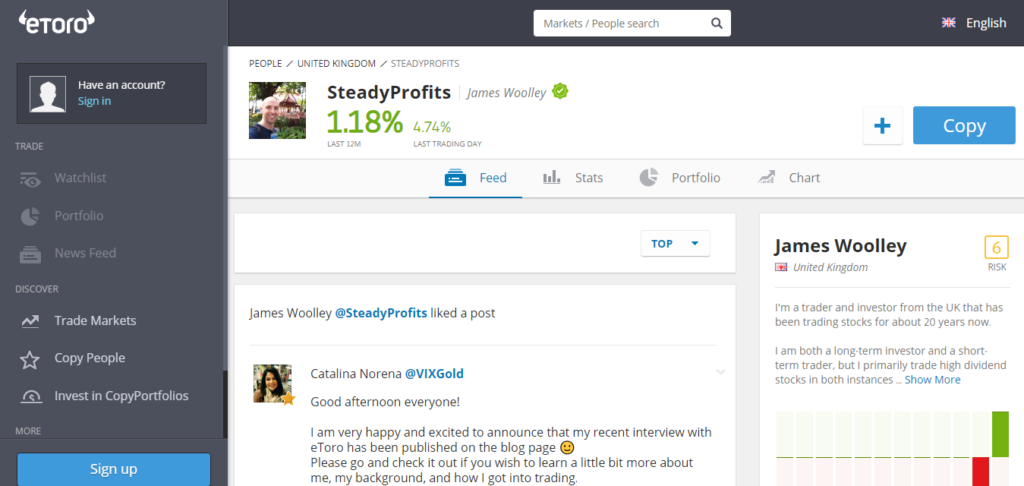

If you read my previous update, you will know that I have been trading CFDs with eToro so far (under the account SteadyProfits) due to my modest account size, which has led me to take a shorter term view that I would normally.

Well all that is about to change because I added some new funds to my trading account earlier today, and so I am now ready to take things a lot more seriously.

By having a larger account, I will now be able to meet the minimum trade size requirements when purchasing stocks, whether for short-term trades or longer term investments, and won’t need to use leveraged CFDs any more, which not only push up my risk score, but also incur small fees every day when they are held overnight.

I have still made some small profits from CFD trading so far, as I will discuss below, but to be honest, I don’t really feel comfortable using leveraged instruments to trade stocks and ETFs because of the fees, which may appear small, but soon add up if you are holding on to positions for weeks or even months at a time.

Recent Results

After a weak start at the end of last month, my trading account is up 6.19% in December, and is now up 1.18% overall at the time of writing, as you can see below:

I’m fairly happy with this after the big market swings that have taken place since I started trading on eToro about one month ago.

At the moment I have no open positions having closed my remaining long positions yesterday, but I did manage to bank some decent profits since my last update by taking long positions on BP (BP.L), Barclays (BARC.L), Imperial Brands (IMT.L) and Lloyds (LLOY.L).

I would have made a lot more, but I got my timing wrong on GVC and ended up cutting my losses on this position, but I will be looking to get back in with an actual share purchase at some point because this stock is grossly undervalued.

Risk Score

As a result of trading CFDs, my risk score of 6 is far too high right now, and I think this will prevent me from being copied in the future, but hopefully this will come down when I stop using leverage.

Future Trades

It looks like the major stock markets are positioning themselves for a Santa rally because they have already risen nicely in the last few days.

Therefore there is a chance that I might not get the opportunity to buy into some of the stocks that are currently on my watchlist, such as British American Tobacco (BATS.L), Imperial Brands (IMT.L), Barclays (BARC.L), Lloyds (LLOY.L), GVC (GVC.L), BP (BP.L), Legal and General (LGEN.L) and Apple (AAPL), but some of them are close to my preferred entry point if there is another sell-off in the markets.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management. 81% of retail investor accounts lose money when trading CFDs with this provider.

Leave a Reply