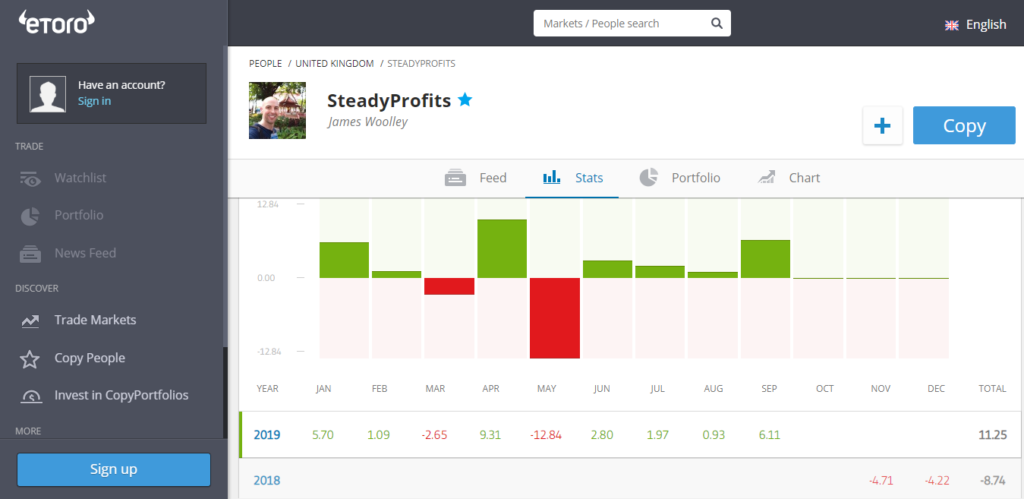

A Very Good Month – Up 6.11%

September turned out to be an excellent month for me because my eToro trading account finished the month up 6.11%, making it the second most profitable month so far since I first opened an account back in November 2018.

It could actually have been a lot better because at one point I was up around 8.5% for the month, but one of the shares in my portfolio issued a profits warning towards the end of the month (more about that later).

I don’t necessarily aim to make huge profits every month. I am quite content to see my account tick along with 1 or 2% gains every month, which is why I chose SteadyProfits as my username, but it’s obviously still nice to see your portfolio grow in value quite substantially in a short space of time.

Popular Investor

Another reason why September was a really good month from a personal point of view is because I was finally accepted into eToro’s Popular Investor program.

This basically means that I can start to be rewarded with a small monetary payment each month if I continue to be profitable in the future and have many people copying my trades.

Trading Performance / Portfolio Update

With regards to my trading, I didn’t place a great deal of trades in September. However there were some significant transactions.

For example, I made the tough decision to sell all of my holdings in GVC. I kind of regret doing this now because I still feel that these shares will be back above 1000p in the not too distant future, but after buying at an average of around 717p and seeing the price fall to around 500p at one point, I took the decision to take a small profit and hopefully buy back below 700p.

Unfortunately this hasn’t gone to plan because the price is now trading close to 750p, but that’s the risk you take sometimes.

Earlier in the month I did manage to bank a more significant profit of 6.2% when I sold a portion of my IAG shares that I bought for 419.7p at 445.1p.

I still have many IAG shares in my portfolio and these have performed well this month, up to around 480p at the time of writing, and pay very generous dividends, so I’m happy to continue holding while I wait for them to hopefully move into profit.

Finally, as mentioned earlier, my other stock, Imperial Brands, issued a profits warning towards the end of the month. This reduced some of my profits as there was quite a big fall, but it did at least allow me to make a quick in and out trade for around 2%.

It wasn’t actually that bad a warning. Profits are expected to be flat this year, but they are still paying a dividend of more than 10%, so again I’m happy to hold on to my remaining shares.

The one other stock is my portfolio is Aviva. This is also down slightly on my purchase price, but has risen sharply this month and also pays a very generous dividend, so I am happy to continue holding for now.

Dividends Received

Unfortunately I didn’t receive any dividend payments this month. The portfolio was boosted entirely by capital gains and trading profits.

However the good news is that two out of the three shares currently in my portfolio, IAG and Imperial Brands, are both scheduled to go ex-dividend in November.

So the portfolio will be boosted once again in the near future, particularly in the case of Imperial Brands because the two final quarterly payments, this being the first one, are the biggest of the year.

Copiers

In this section of this update I normally state that I still don’t have any active copiers, but I’m pleased to report that I now have my first copier.

It’s been such a long wait but I finally have someone actively copying my trades, and it really is a great feeling knowing that I can potentially help someone else make some money from the markets.

Final Thoughts

Overall, September was a fantastic month, and hopefully it will continue for the rest of the year and beyond.

I currently hold three stocks in my portfolio, Aviva, IAG and Imperial Brands, but I am still 33.89% in cash, so I’m patiently waiting for the markets to fall so I can pick up some bargains.

As I mentioned on my eToro feed, I was eyeing up BP, Shell and GlaxoSmithKline but none of them fell far enough, and I was also hoping that the FTSE would fall to around 7000-7200 so that I could buy the FTSE 100 tracker for the long-term but sadly the markets kept going up.

I can’t really complain though because I can’t really lose at the moment. If the markets continue going up, my current portfolio should grow in value, and if they fall I have enough cash in reserve to pick up some undervalued stocks for the long-term and make some potentially profitable short-term trades.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply