Steady Gains – Up 2.21%

October was turning out to be another excellent month for my eToro trading account (account ID = SteadyProfits) as I was up over 4% at one point, but unfortunately some of my share holdings dropped back towards the end of the month after reporting their latest Q3 figures.

As a result of this, my account only finished 2.21% up for the month of October, which is still fairly good, but obviously not as good as it could have been.

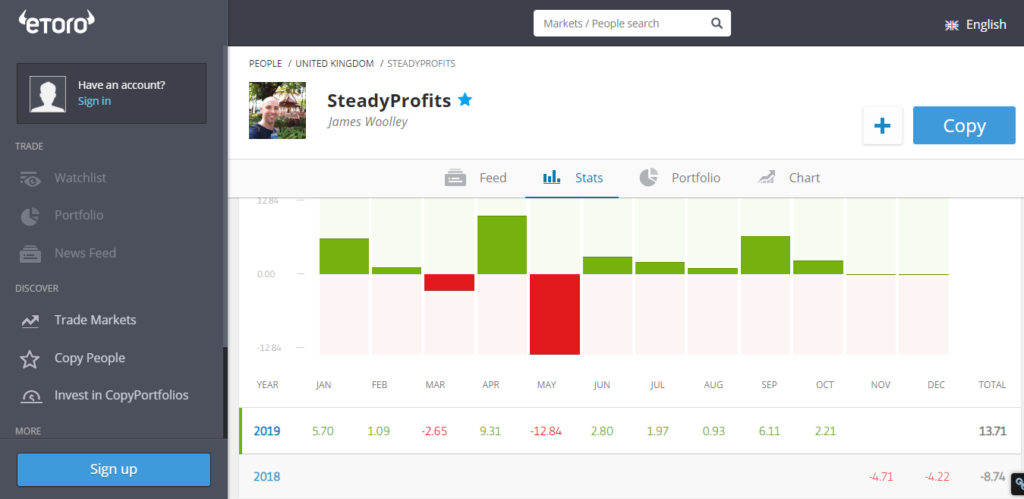

The end of October also brought me to a significant milestone because as you can see from the stats page above, I have now been trading on eToro for 12 months.

I actually picked the worst possible time to start trading and investing in stocks because November and December 2018 were terrible months for the world stock markets, but things have picked up in 2019 and after ending 2018 down 8.74%, my account is up 13.71% so far in 2019, giving me a fairly healthy gain overall.

My aim now is to finish 2019 up more than 15% in total, and I am fairly confident of doing so because I think November and December could be a lot more profitable this year.

Trading Performance / Portfolio Update

In terms of trading, October was quite a busy month. I started off by banking a profit of just over 5% when I sold my Barclays shares, and a few days later I sold my GVC shares that I bought at just under 750p for 820.8p, for a profit of 9.61%.

In addition, I also sold some of my longer-term holds that have finally moved into profit after trading significantly lower in previous months, including Aviva and a portion of my IAG shares.

Finally, I managed to generate an excellent short-term gain by trading GlaxoSmithKline. Having bought at 1631p and 1652.4p a few weeks ago, I closed out both trades when the price moved to 1702.4p just over a week later.

With regards to new trades, I have mainly been buying some of the large-cap giants of the FTSE 100, such as BP, Shell and HSBC, because these have all been pushed down to bargain prices in recent weeks, largely because of weaker Q3 performance, but they all pay a dividend of more than 6% per year and are unlikely to drop much further.

I have also started scaling into the iShares FTSE 100 tracker (ISF), making my first purchase when the FTSE 100 dropped to around 7250, and will add more if it drops back towards the 7000 level.

The only share that continues to disappoint and act as a drag on my portfolio is Imperial Brands, but I’m not going to sell at such a crazy low price, and will simply bank the 10%+ dividend while I wait for it to recover.

Dividends Received

There were no dividend payments this month, but the trading profits more than compensated for this, and the good news is that there are some significant dividends due in November.

BP, Shell, Imperial Brands and IAG are all going ex-dividend this month, and as you may be aware, eToro pay their dividends on these ex-dividend dates instead of the official payment date.

Copiers

In the month of October I had one more person choose to copy all of my trades, which means that I now have a grand total of two copiers on eToro.

This has added an extra level of responsibility, but is one that I am relishing because it is a great feeling to know that my trading is potentially helping other people make money from the markets.

Final Thoughts

Overall it ended up being a slightly disappointing month with my profits tailing off in the last few days of the month, but I’m still fairly happy with my trading performance overall.

I managed to close out some very profitable trades on GVC and GlaxoSmithKline, and bought some excellent stocks at knock-down prices in the form of BP, Shell and HSBC.

Plus to cap it all off, I gained one more copier, and have some juicy dividends to look forward to in November, as well as a potential Christmas rally towards the end of the year, which we didn’t really benefit from last year. So 2019 could turn out to be a very profitable year.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply