A Steady Month – Up 1.83%

I would think most people would be delighted if they could grow their trading account by 1.83% per month, but despite this, I am still left a little disappointed that my eToro account (aptly named SteadyProfits) only grew by this amount in the month of November.

That’s because at times my portfolio was significantly higher than this, and the gains that I had made in previously weeks simply tailed off towards the end of the month as certain shares saw their share prices fall.

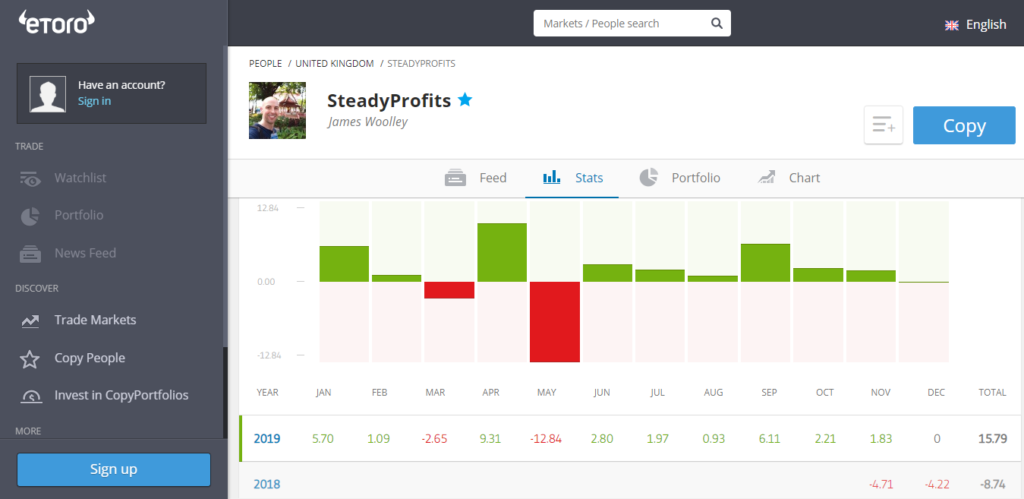

Nevertheless, any growth should be welcomed and as a result of this latest gain, my overall trading account is now up 15.79% for the year, as you can see below:

It is now looking unlikely that I will finish 2019 up 20%, which would have been a fantastic outcome, but you never know. If we get a strong Christmas rally, which we missed out on last year, my portfolio is well-positioned to get close to this magical 20% figure.

Before that, though, I want to give you a run-down of what happened to my portfolio last month, outlining some of the trades that I placed and the dividends that I received.

Trading Performance / Portfolio Update

I started the month off by making a badly timed trade on GVC. This has long been a favourite stock of mine, and after it fell to 848p, I decided to buy some for my portfolio, only to see it fall a lot more, which encouraged me to buy more at 809.2p.

Anyway to cut a long story short, I got scared by the possible threat of increased UK gambling regulations, and sold out for a small loss at around 827.2p. Sometimes you have to take a loss and accept that you made a bad call, and that’s exactly what I did when the share price started to bounce back to a more reasonable level.

I did, however, make three decent trades that made up for this loss. I am a big fan of the FTSE 100 tracker ISF.L because of its high dividend yield of around 4.5% and its long-term growth potential, and traded this on three separate occasions.

First of all I bought at 717.40p at the end of October and sold at 730.1p the following week, and after the FTSE 100 fell back again on two later occasions, I then bought and sold this tracker two more times for gains of over 2% each time.

With regards to my portfolio, I now hold shares in six individual companies, all of which are large-cap FTSE 100 stocks that pay generous dividends and appeared undervalued at the time of purchase, and these are Royal Dutch Shell, BP, HSBC, Aviva, Imperial Brands and International Airlines Group.

IAG has been the best performer this month and is now close to my initial entry price, whilst Imperial Brands is still the weakest performer in my portfolio, although the yield of over 10% somewhat compensates for any running losses.

I recently made a new purchase of Aviva shares, which I am confident of in the long-term and will gladly take the 8% yield that is on offer right now. The other three shares – Shell, BP and HSBC – all traded lower towards the end of November, but once again I am happy to hold these for the long-term and collect the 6%+ annual dividends, payable every three months.

Dividends Received

Considering how low companies such as BP, Shell, HSBC and Imperial Brands have fallen, the value of my portfolio has held up pretty well with an overall gain of 1.83%, and this is because of my trading activity to some extent, but more so because of the dividends that I received last month.

November was actually a bumper month for dividends because BP, Shell, HSBC, Imperial Brands and IAG all went ex-dividend during this month, and because eToro pay their dividends on the ex-dividend date, there were lots of additional funds added to the account ready to be reinvested.

Copiers

Although I need a total of 10 copiers to advance to the next level and start earning a regular payment from eToro, I am actually delighted that I now have four people copying my trades on this social trading platform because this is twice as many as I had at the end of last month.

As always, it is all about results, so I will just keep plugging away and keep trying to make gains, both for myself and my current copiers, and hopefully this will be enough to attract more copiers in the future.

Final Thoughts

The goal of this account is to grow profits slowly and steadily, and so an overall gain of 1.83% is more than satisfactory with all things considered.

There were some good trading profits and plenty of dividend payments to keep the account balance heading in the right balance, and it was only really some significant falls in the two oil giants BP and Shell that prevented the portfolio from making some significant gains in November.

So with just one month left in 2019, let’s hope we get a Christmas rally to finish the year on a high and bank some healthy profits.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply