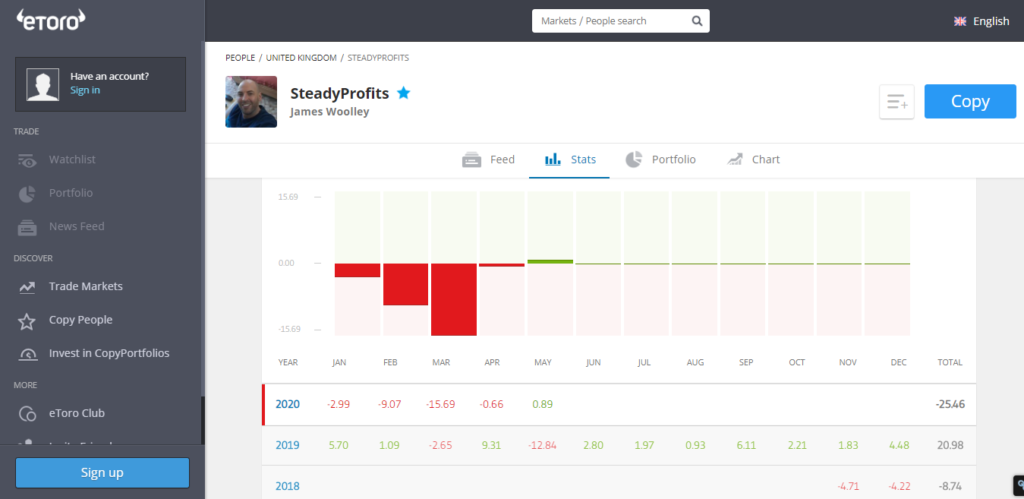

A Modest Gain – Up 0.89%

Last month I was up nicely as we approached the end of April, only to see most of those gains wiped out on the final trading day, and exactly the same thing happened this month as well, much to my disbelief.

I was heading into June with a gain of 4.46% and feeling good about my performance during the month, but the FTSE 100 was down heavily yesterday, and subsequently dragged down the financial and oil stocks in particular, of which I have quite a few in my portfolio.

As a result of all this, I finished the month up 0.89%, which was still better than a loss, but was very underwhelming after I worked so hard to generate profits with my short-term trading.

Trading Performance / Portfolio Update

The portfolio is still well down for the year as a result of this one-day setback, but overall I am not too unhappy with how things stand.

I have banked quite a few profits for my eToro portfolio this month as a result of multiple short-term trades.

For example, I traded in and out of several stocks and ETFs, including ISF, VOO, INVP, AXP, MOMO, RBS, BRK.B and ULVR, and they were all winning trades, with the largest gains coming from MOMO (7.1%) and BRK.B (5.42%).

Investec (INVP) in particular has been a personal favourite of mine this month because I have traded in and out of this stock multiple times, and bought back in once again just a few days ago.

With regards to the remainder of my portfolio, I still have large holdings in the recovering oil sector with BP and Royal Dutch Shell, and also hold a number of financial stocks, such as Aviva, Barclays, Royal Bank of Scotland, Visa and HSBC.

I also have the very undervalued US-listed Chinese app MOMO, and hold ISF and SPY, which track the FTSE 100 and S&P 500 respectively.

Finally, I currently hold a small amount of short-term treasury bonds with SHV to provide a regular monthly income, although this can always be sold if I see some better opportunities in the markets.

Dividends Received

There were very few dividend payments due to be received this month, particularly after many of our companies announced that they were scrapping dividends for the rest of the year.

However we did still receive a small payout from our ETFs, namely SPY and SHV, and we can look forward to some much larger payouts next month, with payouts expected from Visa, BP, Royal Dutch Shell, ISF and SHV.

Copiers

I ended last month with four copiers, but one of those left me this month, so I am now left with three copiers.

Nevertheless, it doesn’t matter if I have 1 or 1000 copiers. I will always do my best to make sure that each and every one of them is profitable.

Risk Score

One reason why it has been hard to attract new performers (apart from my underperformance in 2020) is that my risk score has gone up to 7.

Many people will see this score and instantly assume that I am quite a risky trader, but that’s not the case at all. I always run a long-only portfolio and never use leverage. It has gone up purely because of the volatility of the markets.

Of course I do still want to bring it down if possible, particularly as I know that I have too much exposure to certain sectors, but it is hard to do so right now with many of these stocks trading at very low levels.

Final Thoughts

Overall, it would have been a very good month if it wasn’t for the big fall in the UK market on the last day, so I am not too disappointed. The markets may well recover next week, particularly with the UK and US economies starting to open up again, and I am confident that the oil stocks will bounce back with the oil price rallying strongly late on Friday.

Of course there is still a long way to go just to get back to break-even for the year, but I think the portfolio is heading in the right direction, and as mentioned above, it will be boosted by some decent dividends in June, which will obviously help.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply