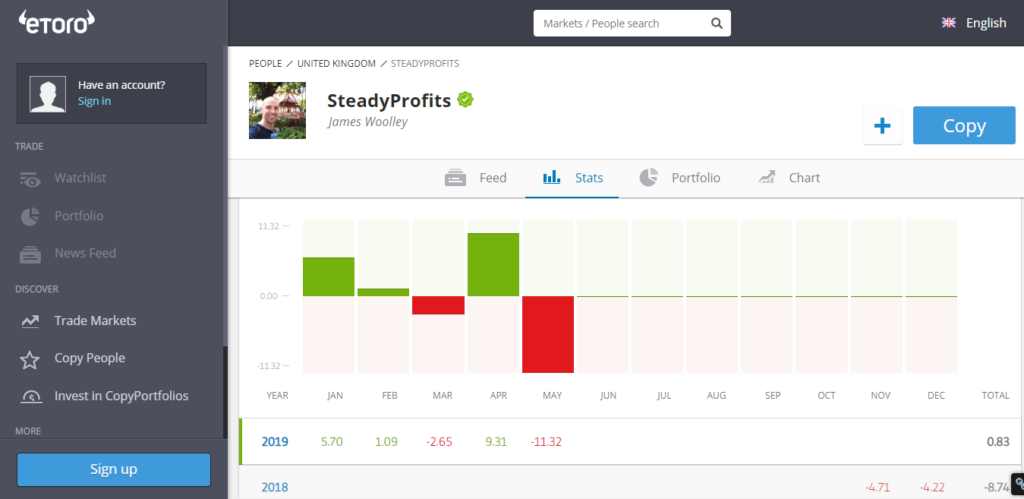

My Worst Month Yet – Down 11.32%

I started last month’s update by saying that this had been my best month yet because I was up 9.61% at that time, and I actually ended the month up 9.31% in the end.

However I’m sad to say that all of those gains have been wiped out because May has been my worst month yet.

At the time of writing I am currently down 11.32% this month, and am now only up 0.83% for the year, which is a poor performance.

Reasons for the Heavy Losses

The main reason for my heavy losses is because of the whole mess surrounding Brexit. With Theresa May resigning and the threat of a no-deal Brexit coming back once again, my portfolio has taken quite a beating because I am only holding UK stocks right now, and most of these are heavily susceptible to any adverse news regarding Britain’s exit from the EU.

The markets hate uncertainty, and unfortunately there has never been so much uncertainty in the British economy. At the moment we even don’t have a prime minister, and we still don’t know if there will be a soft Brexit, a no-deal Brexit, or even a second referendum.

In addition to this, we have also had the trade war between the US and China, which has weighed heavily on the markets.

As a result of this, the stock markets have fallen, with the FTSE 100 going from over 7500 to around 7140, before recovering to its current level of 7270.

I’m not going to make any excuses though. Shares go up and down in the short-term but good quality companies generally grow their earnings and their dividends every year, and so I’m not overly concerned.

Dividends Received

I haven’t been actively trading that much this month, choosing instead to sit on my portfolio of stocks and wait for my stocks to recover, and it has also been fairly quiet on the dividend front as well.

This month I just had one stock going ex-dividend – Imperial Brands (IMT.L) – and thanks to eToro’s dividend policy, this has already been added to my account.

Copiers

Unsurprisingly, after having such a poor month, I still don’t have any new copiers, and I wouldn’t expect to either.

However I am taking a long-term approach and am hopeful that I will soon have some active copiers once my portfolio is looking a lot healthier.

Final Thoughts

With my portfolio down 11.32% for the month, it would have been very easy for me to avoid doing a trading update this month, but I promised to document my journey as a trader on eToro, and so for completely transparency, I have to talk about both the highs and the lows.

It is never nice to see your portfolio go down so much in such a short space of time, but I am not at all worried because I am almost certain that every single stock in my portfolio will move into profit at some stage, and in the meantime I am happy to collect the dividends while I wait.

Indeed as soon as there is some clarity regarding Brexit, many of these stocks should surge higher almost immediately, but even if they don’t, I am confident of a recovery because I bought them all at a good price when they were on a very low P/E ratio, and they are all predicted to continue to grow their profits in the coming years.

My current portfolio includes GVC (GVC.L), Imperial Brands (IMT.L), International Consolidated Airlines (IAG.L), Barclays (BARC.L) and Aviva (AV.), and I would be happy to buy them all at today’s prices if I had some additional trading capital.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply