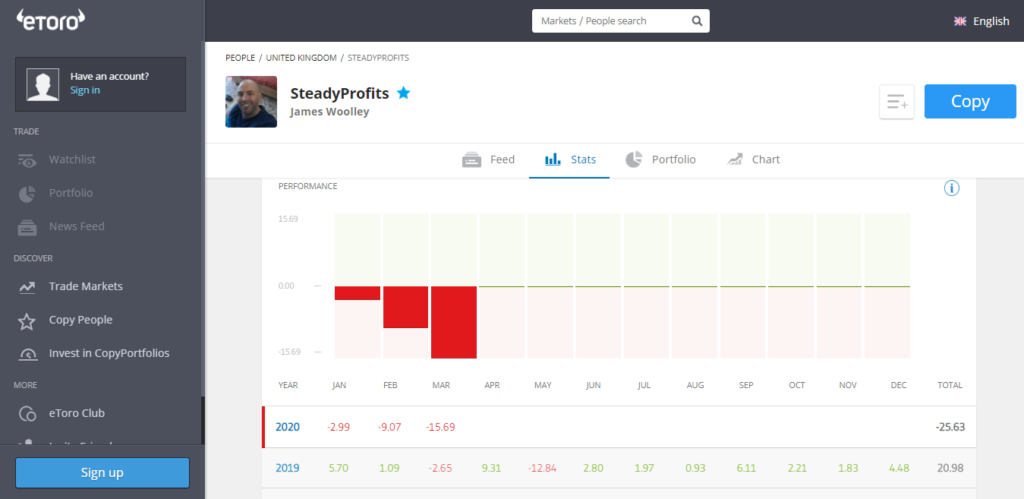

Worst Month So Far – Down 15.69%

First of all, I would like to apologise for not continuing to post monthly updates about my eToro progress in recent months.

As many of you will know, March has been a terrible month for stock market investors, so I thought now would be the perfect time to write a new update.

The impact of COVID-19 around the world has had a devastating impact on many countries’ economies and has decimated many people’s portfolios as a result, including highly respected fund managers such as Ray Dalio.

I have suffered as well because after the final day of trading, my account was down 15.69% in March, following on from a fall of 9.07% in February and a 2.99% fall in January.

Trading Performance / Portfolio Update

Many people assume that the coronavirus is responsible for most of these losses, but in my case, the ongoing dispute between Saudi Arabia and Russia has also had a major impact because this has driven the price of oil down to just $22 in the case of WTI Crude.

Subsequently, I have seen the share price of two of my largest holdings, BP and Royal Dutch Shell, fall by as much as 50% before bouncing back to a slightly more respectable level.

Other companies in my portfolio have performed equally as badly thanks to the enforced lockdown in the UK and elsewhere.

For example, HSBC is down over 20%, Aviva is down over 30% and RBS and Barclays are both down around 34%. Even my FTSE 100 tracker is down nearly 22%.

My US stocks and ETF have performed a little better because I purchased these a little later using the proceeds from my bond ETF sales.

Visa is down around 19%, Google 11% and SPY (a popular S&P 500 tracker) around 16%.

In short, everything is down a lot but I am not currently selling anything for a loss because these are all good quality companies / ETFs that should all go back into profit over time once we start to eradicate COVID-19.

Most of them pay very generous dividends in the meantime, although I am just hearing that UK banks are all cancelling any future dividends for the remainder of 2020, which is obviously a big blow.

It should be noted that it hasn’t all been doom and gloom because as mentioned above, I sold three of my bond ETFs for decent profits last month, and I also made a profit of over 15% on a short-term trade in Barclays.

Dividends Received

eToro have recently changed the way that payments are received so that they are now in line with most other brokers. Instead of paying out dividends on the ex-dividend date, they now pay the dividends on the official payment date for each company.

As a result of this, I received dividends last month from a few companies that went ex-dividend in February, including Visa, ISF, BP and Royal Dutch Shell, so this provided a decent income to mitigate some of the heavy losses.

This month there are more dividends due to be paid out from SPY, but the anticipated dividends from Barclays and HSBC have now been cancelled.

Copiers

At the start of the year I had as many as 8 copiers copying my trades at one point, but with the global stock market collapse, I now only have 3 copiers, which is perfectly understandable.

I am invested for the long-term with short-term trades boosting profits in the meantime and am fully prepared to ride out any storms, but everyone has their reasons to stop copying someone.

Risk Score

As a result of some wild fluctuations in the value of my portfolio, my risk score has gone up from 4 to 6, which is obviously not ideal. Hopefully this will fall once the markets settle down a little bit and stop moving several percentage points in one day. If not, I may have to trim some of my larger holdings.

Final Thoughts

Overall, I am not too unhappy with the overall loss of 15.69% in March, as crazy as that may sound. I was actually down a lot more at one point when the FTSE and S&P 500 were down significantly more than they are today.

The key thing you have to do during a crisis is to avoid panic selling. As long as you are invested in good quality stocks and ETFs, you should be OK in the long run, however long that may take, and I believe I have a good mixture of both.

So for now I am just continuing to bank any dividends and waiting for this coronavirus nightmare to be over. Stay inside, stay healthy and keep buying at low prices is my philosophy for the immediate future.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply