Not A Good Month

There was a time at the start of the month when the portfolio was in really excellent shape. I banked some small short-term profits on various stocks, sold a few of my longer-term holdings for a decent profit, such as Apple, for example, and my largest holding, GVC, was now nicely into profit when it was trading above 700p.

However the trouble is that if you invest too much into one stock, and that company announces some bad news that sends the share price tumbling, your portfolio can take a big hit, and that’s exactly what happened.

After a positive trading update from GVC, there was an RNS shortly afterwards announcing that both the chairman and the CEO sold a large number of their shares at a discount, which caused many investors to sell their shares in the fear that there was some bad news on the horizon, and encouraged traders to open short positions.

Subsequently the price has gone from over 700p to just over 500p, but the good news is that the CEO has announced that he won’t be selling any more shares, and has hinted that the company is still in good shape, which has helped the price recover to around 550p.

To be fair, I have a few other stocks in my portfolio that are down a little since I bought them, so this too has contributed to a fall in the overall value of my portfolio.

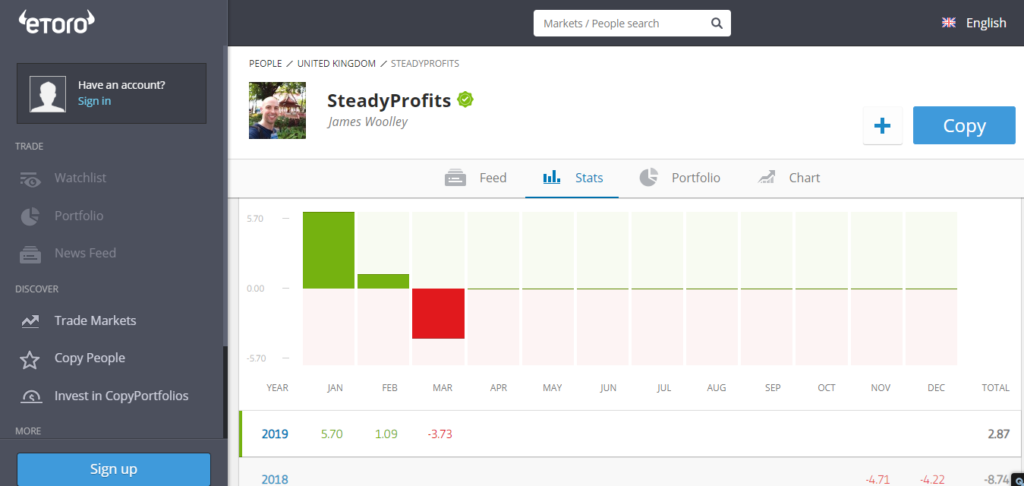

The net result of all this is that the portfolio is now down 3.73% for the month of March with two full trading days left.

Trading Summary / Dividends

With regards to my trading activity this month, I sold both of my holdings in Barclays (BARC.L) that I bought last month for a decent profit (plus I also received the dividend as well during this time).

I also took the opportunity to sell about 30% of my GVC (GVC.L) shares when the price got to 722p. With the benefit of hindsight, I wished I had sold all of my GVC shares because the price subsequently fell sharply, but I am still a firm believer in this company and based on future forecasts, it should still be trading around 700-800p at the very least in the future.

For that reason, I ended up buying some more shares at 587p, and received a healthy dividend when the shares went ex-dividend on 14 March.

In addition to this, I sold my shares in Domino’s Pizza (DOM.L) for a very small profit when the opportunity arose because I wasn’t really comfortable with my initial entry price, and then traded it again when the price dropped for a bigger profit.

I also sold my shares in Apple (AAPL) for an excellent profit at around $181.63. I was intending to hold on to them in the hope that they would reach $200, but I decided to bank some profits instead.

Finally, I also managed to bank a profit of around 3.73% trading Aviva (AV.L), so in terms of trading it was a good month, but GVC and a few long-term investments have pushed the overall value lower this month.

Current Portfolio

At this moment in time, GVC is still my largest holding, closely followed by International Airlines Group (IAG.L), which is ridiculously undervalued based on future forecasts and is due to pay a massive dividend later this year.

The rest of my portfolio is made up of financial stocks, similar to Warren Buffet, and includes Aviva (AV.L), Barclays (BARC.L) and HSBC (HSBA.L), all of which are very cheap based on fundamentals and pay an excellent dividend.

Closing Comments

Overall I am obviously disappointed with the whole GVC situation (I don’t think the directors realised how much of an affect their share sales would have on the share price) and the overall performance of my portfolio this month, but as my eToro username (SteadyProfits) suggests, my goal is to make steady profits over time, and I am 100% confident that the GVC share price will slowly recover and the other stocks in my portfolio will start to come good.

In the meantime I am more than happy to keep on accumulating dividends and reinvesting them into good quality high-dividend stocks. It’s all about being patient and reinvesting both profits and dividends, and if I keep on doing this, I’m sure that my portfolio will eventually be in really good shape.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investor accounts lose money when trading CFDs with this provider.

Leave a Reply