A Nice Recovery – Up 2.81%

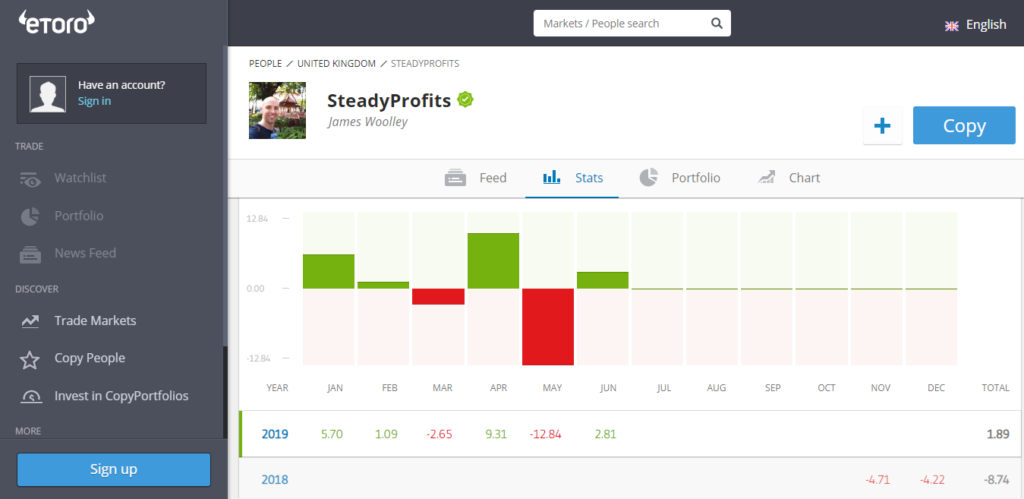

If you have been following my eToro updates for a while, you will know that May was my worst month so far. After being nicely in profit for the year, my portfolio ended up losing 12.84% in value in a single month after the FTSE fell sharply.

Well the good news is that my portfolio bounced back a little in June, finishing 2.81% higher at the end of the month.

There is obviously still a long way to go to get back to where I was, but I am still fairly happy with this overall performance.

Dividends Received

This was one of the few months where I didn’t actually receive any dividends, so unfortunately I do not have any excess cash to reinvest back into the markets at the current time.

However the biggest holding in my portfolio is International Consolidated Airlines (AIG.L), and this is due to pay a huge special dividend when it goes ex-dividend in a few days time. So this will give me a decent amount of cash to reinvest.

In addition to this, Aviva (AV.L), Barclays (BARC.L) and Imperial Brands (IMT.L) are all due to go ex-dividend in August, with GVC (GVC.L) going ex-dividend in September, so this will definitely boost my portfolio.

Trading Performance / Current Portfolio

I haven’t actually placed any trades in the last month, therefore my current portfolio is still the same as before.

My largest holding is still IAG, but I am also heavily invested in GVC, Barclays, Imperial Brands, and to a lesser extent, Aviva.

In terms of performance, all of these stocks are currently in the red, but they are all massively undervalued right now, and I’m not overly concerned going forward because I am sure that they will all move into profit over time. In the meantime I will just sit back and collect the dividends while I wait for them to recover.

I am particularly bullish about GVC and IAG because these could both be trading at twice their current share price and still be fairly valued, but I think Barclays and Aviva are both fairly safe long-term holdings as well.

The only holding that I am slightly concerned about is Imperial Brands because this has performed really badly in recent months with so much negativity surrounding the tobacco industry as a whole. If I can get out at break-even at some point, I will probably do so, and will probably avoid this sector going forward.

Copiers

As my trading account is still in the red overall, I still don’t have any active copiers, but I’m absolutely fine with that. This will only happen when my account is showing sustained profits over long periods of time.

Final Thoughts

Overall it has been a fairly subdued month with little trading activity and no dividends added to my account, but as always, I am still confident that the value of my portfolio will bounce back strongly in the future.

All five of my holdings are hugely undervalued and it should hopefully only be a matter of time before the share prices reflect their true value.

However the reality is that this will probably only happen once we get some clarity regarding Brexit because at the moment there is still no clear resolution to this problem with no leader in place and no real plan of action.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply