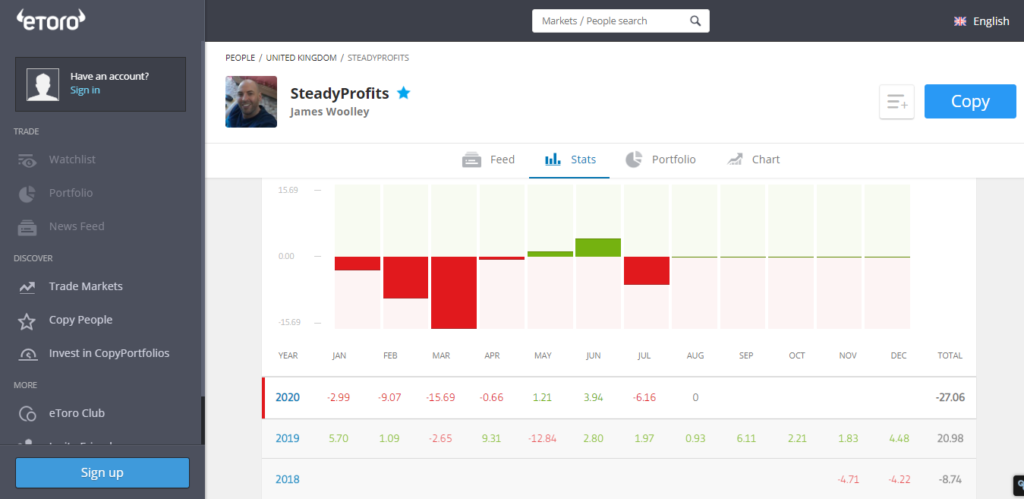

A Poor Month – Down 6.16%

July proved to be a very disappointing month for my eToro account with an overall fall in value of 6.16%.

I did manage to close out a few positions for a decent profit and also received some dividends during the month. In addition, my US stocks held up pretty well. It was my UK stock holdings that did all the damage, as I will discuss below.

Trading Performance / Portfolio Update

With regards to my trading performance, I managed to bank some decent profits last month.

Tesla (TSLA) was the biggest success story with a total profit of 14.95%, but I also took the opportunity to bank 10.37% from Lockheed Martin (LMT) and over 7% from Coca Cola (KO).

I also banked a 6.18% profit from selling Duke Energy (DUK) and 5.74% from Wells Fargo (WFC) and Investec (INVP).

There were also multiple gains between 1 and 5% across multiple stocks that I closed out during the month, so there were some decent profits made.

The main problem is that when my largest holdings fall sharply, it really drags the whole portfolio down, and that’s exactly what has happened because HSBC (HSBA), BP (BP), Royal Dutch Shell (RDSB) and Aviva (AV.), for example, have all seen their share price fall quite dramatically.

The strong pound has been a major contributing factor to this because many of the biggest UK companies report their earnings in US dollars, but the worsening COVID-19 situation and increased restrictions regarding the opening up of the country haven’t helped either.

Luckily some of my US stocks have been performing well. My first investment into Amazon is doing well, currently up 7.84%, and other stocks such as Microsoft (MSFT), Altria (MO), IBM (IBM) and Momo (MOMO) are also nicely in profit.

Dividends Received

There were no massive dividend payments in July, but we did still receive payouts from Danone (BN.PA), Simon Property Group (SPG) and our S&P tracker SPY.

We have a lot more payments due this month, particularly from our US stock holdings, which generally tend to pay out quarterly.

Copiers

The number of people on eToro who are copying my trades remained unchanged at 3 last month.

It really does make me feel bad seeing some of my copiers down quite a lot since they first started copying me before COVID-19, but I remain confident that they will all be in profit in due course if they are prepared to stick with me.

Furthermore, any new copiers who come on board in the near future should be well rewarded in the long term because they will be buying some good quality companies at very low prices when copying open trades.

Risk Score

One positive from last month is that my risk score has now come down to 5. This is a reflection of slightly lower volatility in the markets and increased diversification across companies and sectors.

Final Thoughts

After such a negative month, I am obviously hugely disappointed. The UK market in particular is really having a negative impact on my portfolio because my largest holdings are all UK stocks in the financial and oil sectors that have been hit hard by the effects of COVID-19.

Unfortunately these are only likely to bounce back when a successful vaccine is developed that enables daily lives to get back to normal, and that could still be several months away.

So it is just a case of being patient, and trying to make some short-term gains when the right opportunities present themselves while I wait for the longer-term holdings to recover.

Follow Me on eToro

If you would like to follow my journey on eToro, simply open an eToro account and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.

Leave a Reply