My Initial Impressions of eToro

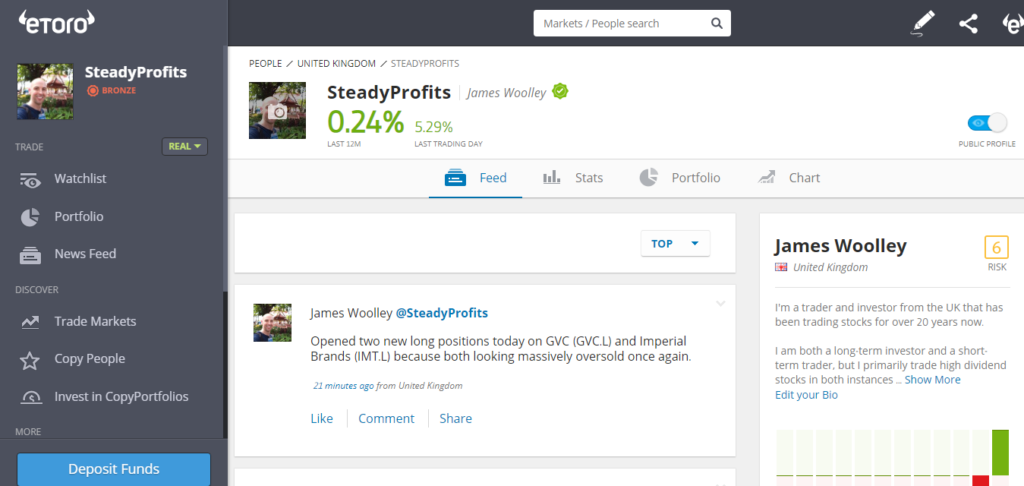

I have been trading on eToro for a few weeks now (my profile is SteadyProfits), and it has been an interesting experience so far.

I have found that the platform is really easy to use, and it is really easy to open and close trades, monitor your portfolio and track your positions.

I also like the detailed stats that are provided about your trading, such as your overall win percentages, and the social aspect of the site because you can explain the rationale about your trading decisions.

Early Trading Results

As mentioned in a previous post, I only intend to trade stocks and ETFs with this account with the aim to grow my account steadily over time, primarily by trading and investing in good quality high-dividend stocks.

I have stuck to these rules so far because I have traded ISF.L (the ETF that tracks the FTSE 100), as well as Lloyds (LLOY.L), GVC (GVC.L), Imperial Brands (IMT.L) and Galliford Try (GFRD.L).

Results have been mixed because I am still limited to trading CFDs due to my relatively modest account size, which has forced me to take a relatively short-term view when finding stocks to trade due to the overnight fees that you have to pay.

Normally I would like to buy physical shares and hold on to positions for a lot longer, ie weeks, months or even years, and so as soon as I deposit a much larger amount of capital, my trading style will change and hopefully my average risk score will go down.

At the moment my risk score is 7 for this month (6 overall), presumably because my portfolio swung into profit after being 4% down at the end of last month, which is far too high, but hopefully it will come down when I start trading physical stocks instead of leveraged CFDs.

At the time of writing, I am currently up just 0.24% since I joined eToro, which is not too bad considering that many UK stocks are taking a hammering right now due to the possibility of a no-deal Brexit, but I am really confident that my profits will grow substantially in the future once the political picture becomes clearer and I have deposited more money.

Limitations of eToro

One thing I have noticed is that although you can trade more than 300 UK-listed stocks, they don’t offer markets for every single share.

For example, they don’t have a market for Taylor Wimpey (TW.L), which is a large FTSE 100-listed housebuilder that I like to trade, and if you want to trade companies that are listed on multiple exchanges, such as Vodafone and Shell, you cannot trade the UK-listed companies, which is a little annoying.

However these are just a few small complaints that I have. Overall, I am more than satisfied with the eToro platform so far.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management. 81% of retail investor accounts lose money when trading CFDs with this provider.

Leave a Reply