The Popularity of Cryptocurrency Trading

Many people from all over the world have made life-changing sums of money from buying Bitcoin several years ago when it was a fraction of the price that it is today, and people are still purchasing Bitcoin and other cryptocurrencies right now in the hope of making 2, 5 or even 10 times their investment back.

However it is not just investors who are looking to profit from cryptocurrencies because there are many traders who are choosing to trade these markets using conventional spread bets and CFDs.

The benefit of this is that traders can choose to open long positions and short positions, and because they can trade on margin, they don’t need to actually own any of the cryptocurrencies that they wish to trade.

New 50% Margin Rate for Cryptocurrency Traders

The bad news for traders based in Europe is that they are now going to need more capital in their trading accounts in order to trade these cryptocurrencies.

The bad news for traders based in Europe is that they are now going to need more capital in their trading accounts in order to trade these cryptocurrencies.

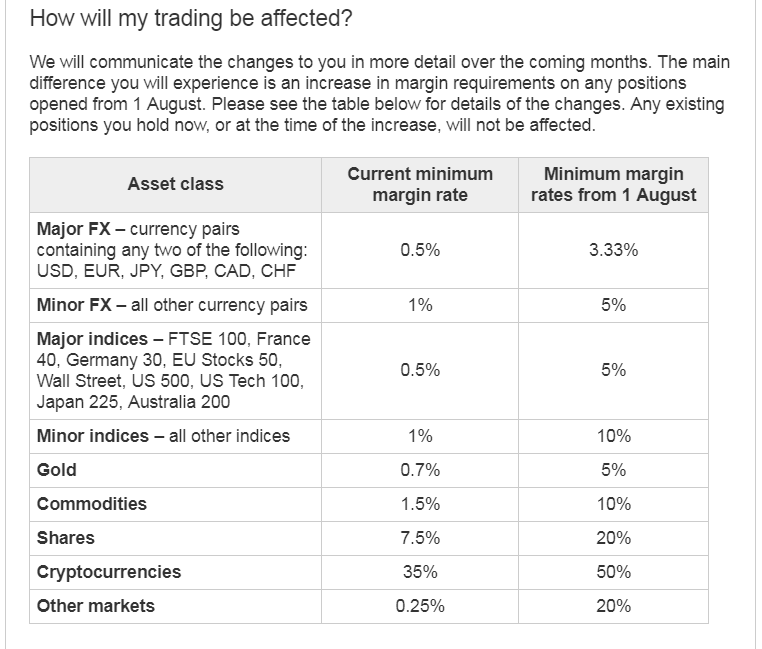

As I discussed in my last blog post, the ESMA are introducing new margin rules in order to protect traders and investors, and in the case of cryptocurrencies, the new margin rate has been increased to 50%.

This could potentially create problems for a lot of short and medium-term traders because they may well need to deposit more capital just to cover their positions, and to enable them to open new positions when trading these markets.

To give you an idea of how much capital you will need to trade cryptocurrencies, let me give you some examples of how much you would need to open a relatively small long position on Bitcoin and Ethereum, two of the most popular markets, based on today’s prices.

Margin Requirement Examples

Bitcoin – £1 long at 8250, margin = 8250 x £1 x 50% = £4125

Ethereum – £10 long at 481, margin = 481 x £10 x 50% = £2405

So as you can see, it is going to be hard for smaller traders to trade these instruments in the future because the margin requirements are now going to be a lot higher.

However it is easy to see why the ESMA have increased the margin requirements because cryptocurrencies in particular are exceptionally risky, and it is certainly possible for people to lose all of their money in some worse-case scenarios.

You now have even more of an incentive to open a demo account with ZuluTrade because they will shortly be running a demo trading contest where you can put your trading skills to the test and compete against other people to see who can generate the most profit.

You now have even more of an incentive to open a demo account with ZuluTrade because they will shortly be running a demo trading contest where you can put your trading skills to the test and compete against other people to see who can generate the most profit.