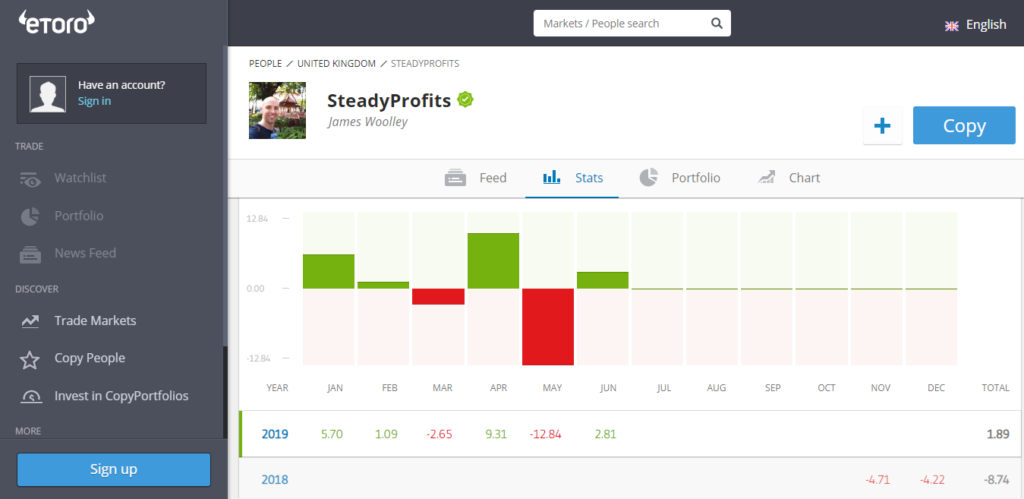

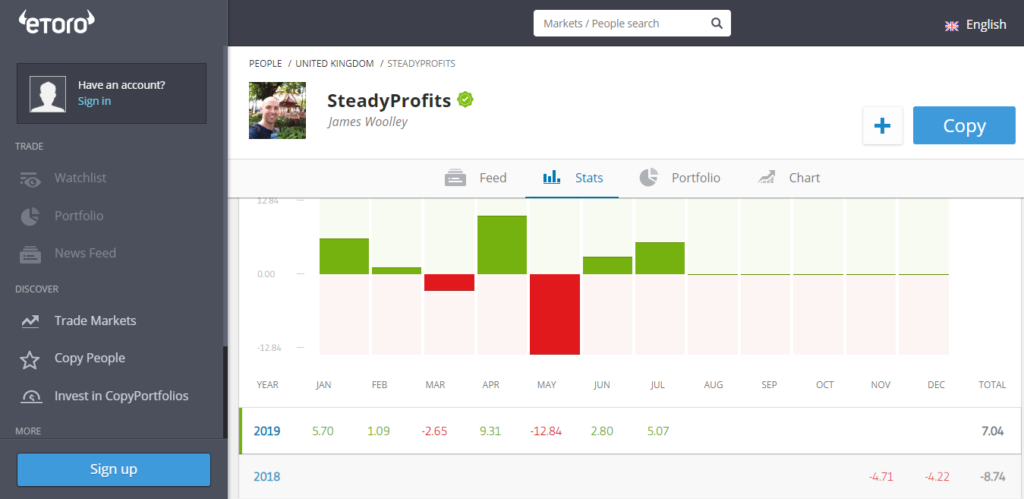

Solid Performance – Up 5.07%

After the heavy falls that I incurred back in May, June proved to be a good recovery month with the value of my eToro portfolio going up by 2.8%, and July has been an even better month so far with the value of my portfolio going up by 5.07% with just two trading days left.

As you can from the screenshot of my portfolio performance below, or by checking out my SteadyProfits account on eToro, this 5.07% gain combined with my previous monthly performance figures for 2019 means that my portfolio is now up 7.04% in 2019.

This is not really something to shout about because the portfolio fell 8.74% in the last two months of 2018 when I first started trading on eToro, but I’m still fairly happy that my portfolio is now heading in the right direction, particularly with additional dividends due to be paid for many of my stocks in the next few months.

Dividends Received

This month was helped a lot by the fact that one of my biggest holdings, International Airlines Group (IAG.L), went ex-dividend, and as you probably know, one of the main benefits of eToro is that the dividend is paid straight into your account on this ex-dividend date.

I didn’t receive any other dividends this month but IAG paid both an ordinary dividend and a special dividend, and so even after eToro deducted their fees, I still received a total dividend of around 4.91% from this one holding.

Trading Performance / Current Portfolio

July was a fairly busy month from a trading point of view. At the start of the month, I sold my shares in Aviva (AV.L) for a profit of 2.21%. I also sold a small tranche of my GVC (GVC.L) shares for a short-term gain of 2.62%.

In addition to this, I traded out of Barclays (BARC.L) for a small profit, and sold my newly acquired BP (BP.L) shares yesterday for a small profit of around 1% because I didn’t want to hold on to them on results day (which was today).

Apart from this, I ended up buying some more shares in Aviva (AV.L) because they are currently very undervalued and still pay a very generous dividend, and still have my long-term stocks, GVC and IAG, which haven’t performed too well of late but are still very cheap based on their long-term earnings forecasts.

My other holding is Imperial Brands (IMB.L), which has bounced back strongly this month, but is still below my initial entry price. So this is another stock that I am prepared to hold for the long-term and collect the quarterly dividends while I wait.

Talking of dividends, the next few months should be beneficial for my portfolio because Aviva and Imperial Brands are both due to go ex-dividend next month, and GVC is due to pay another strong dividend in September.

Copiers

As I seem to say every month, I still don’t actually have any active copiers on eToro, which is disappointing. However I am just going to keep trying to make money as usual, and hopefully the copiers and followers will eventually come if I can continue to grow my portfolio and achieve steady profits, as per my username.

Risk Score

The one thing I have noticed is that my risk score has recently dropped from 5 to 4, which has to be beneficial because most eToro users are interested in finding profitable traders that don’t take too many crazy risks and who generally trade sensibly.

Final Thoughts

I have become a little disillusioned with eToro if I’m being honest because of the lack of copiers and the need to document every trade and dividend received for tax purposes, unlike an ISA, for example, where all the gains and dividends are tax-free.

Indeed I did actually consider withdrawing all my money and adding it to my ISA account, but for now I think I am going to continue trading with eToro for the foreseeable future and see how well I can do.

I know that I am capable of growing a portfolio quite substantially because I have done just this with my ISA. I think it will just take time for the compounded dividends and gains to start to really take effect, and the whole mess surrounding Brexit isn’t exactly helping matters either right now as I only hold UK stocks at the moment. So let’s see how the rest of 2019 pans out.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment or portfolio management advice. 81% of retail investors accounts lose money when trading CFDs with this provider.