A Profitable February

After the dramatic stock market falls that we saw in December (just after I started trading on eToro) and the rebound that we saw in January, it is fair to say that February has been a lot quieter in comparison.

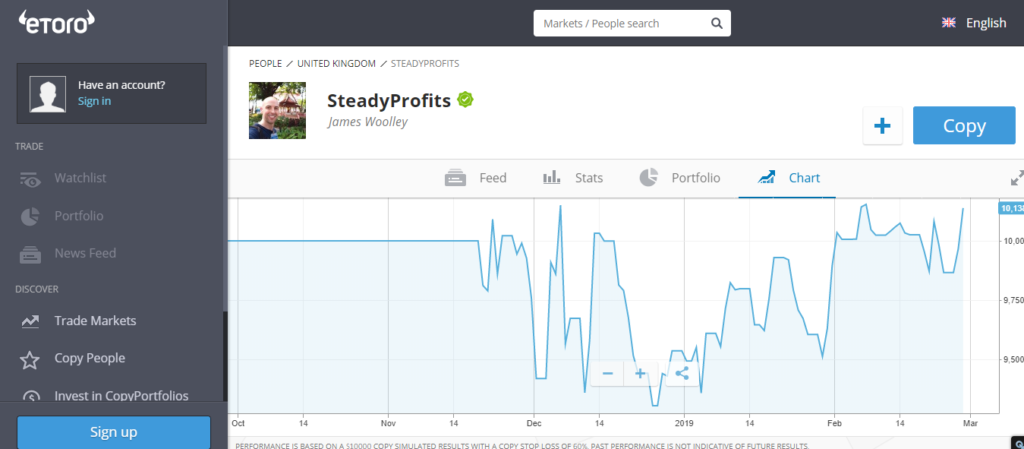

Nevertheless, I did manage to post some small gains from my trading (my portfolio is currently up 1.49% for the month with just a few trading days left), and the good news is that at the time of writing, my portfolio is now in profit overall, as you can see from the chart below:

A notional starting balance of $10,000 is now worth $10,138.76, which is not bad at all because despite all the turmoil, it represents an overall gain of around 1.39%.

Of course I would have liked to have made a lot more in the last 3 months, but it was a difficult time to be invested in stocks, and overall I am fairly content with my current portfolio and its future growth and dividend-earning potential.

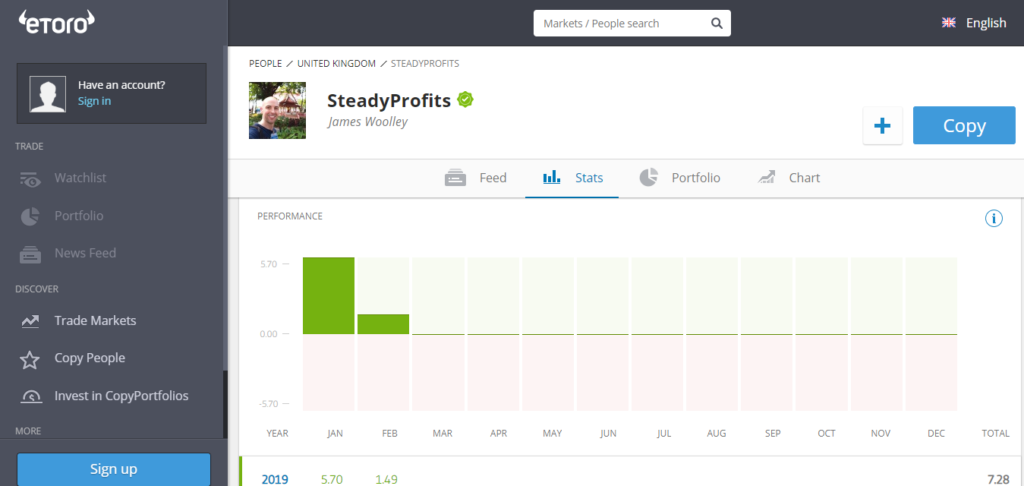

Here are the monthly returns for January and February 2019 so far:

Current Portfolio

After having quite a lot of spare cash sitting on the sidelines, I am now almost fully invested.

My portfolio is currently 100% in stocks, and my largest holding is still GVC (GVC.L), the global sports betting company that is rapidly expanding into the US market with a joint venture partnership with MGM.

They are due to report their latest trading results next week, and as is so often the case, the markets are expecting some more solid results, with a possible dividend increase to come.

The share price has actually been trading at very low levels with the gaming sector currently out of favour, but it has bounced back sharply this week, and is now not far below my average entry price.

Apart from this, I still have a decent holding in Apple (AAPL), which is currently in profit, but I am not planning to sell this until it is at least $200.

I decided to buy into two banking stocks this month, namely Barclays (BARC.L) and HSBC (HSBA.L), which has had mixed results, but it is still early days.

Barclays is up nearly 4.74% at the time of writing, but this will be reduced back towards my initial entry price because it goes ex-dividend tomorrow.

However at least the dividend goes straight into your account on this date with eToro, and you don’t have to pay until the official payment date, even though you only receive 85% of the total dividend payout.

HSBC is actually down a similar amount right now (4.33%), but it has recently gone ex-dividend. So this running loss has been negated somewhat by the 2% dividend that I received last week, and there are more dividends due every three months.

Finally, I also decided to buy Domino’s Pizza (DOM.L) this month because this is another good dividend stock, and is currently very undervalued based on future projections for the next few years.

With regards to outgoings, I sold my FTSE 100 tracker (ISF.L) and my holding in British American Tobacco (BATS.L) for a decent profit of 2.41% and 4.03% respectively, and also closed out my investment in Philip Morris (PM) for a very small profit, but this has turned out to be a mistake in hindsight because it has continued to surge higher.

Dividends

As I mention in my bio, dividends are very important to me, which is why I will predominantly trade stocks and ETFs that pay decent dividends, regardless of whether I am trading with a short-term or a long-term view.

Capital growth is great, but over time the effect of reinvested dividends cannot be underestimated, and the good news is that more and more dividends are now starting to be added to my portfolio.

This month I received dividends from Apple and HSBC, and I have another generous dividend payout from Barclays due tomorrow morning. Plus there is also a large dividend payout from GVC scheduled for next month, as well a final dividend from Domino’s Pizza to look forward to.

Closing Comments

My first few months trading on eToro were fairly tough due to the plunging markets, but I am very happy with my performance in 2019 so far because I am now back in profit and regular dividends are now starting to come through.

I didn’t actively trade that much this month because the markets are very high and there are few bargains to be had, but I am still happy to have picked up some shares in Barclays, HSBC and Domino’s Pizza, which should do well in the long run.

The only real disappointment is that I still don’t have any active copiers, but I’m sure that will come in due course if I can continue to grow my portfolio.

Follow Me on eToro

If you would like to follow my journey on eToro, simply go to the eToro website and search for SteadyProfits to view my live trading results and to see my latest trades.

Past performance is not an indication of future results. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management. 81% of retail investor accounts lose money when trading CFDs with this provider.